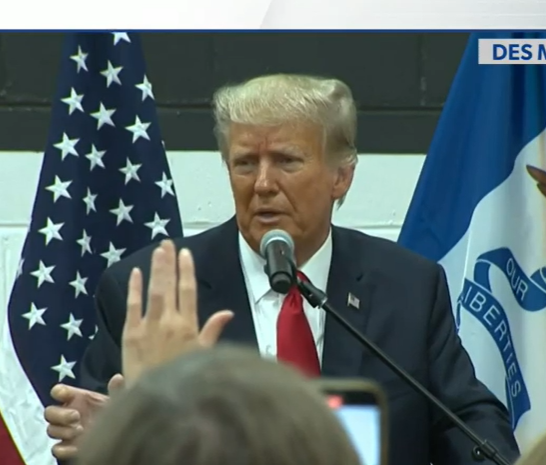

5 key takeaways from the first day of the Trump hush money trial

- Donald Trump's first criminal trial commenced on Monday

- The trial highlights the unusual scenario of a potential presidential nominee facing legal proceedings

- The trial's opening day saw Trump actively involved, observing legal debates over admissible evidence

Is Shohei Ohtani married?

- Shohei Ohtani announced his marriage to a special person from Japan, keeping her identity undisclosed

- He clarified her non-involvement in his move from the Angels to the Dodgers

- Ohtani's announcement coincides with his promising outlook for the 2024 MLB season

Who was Thomas Kingston? Prince Michael son-in-law dies of a ‘traumatic head wound’

- Thomas Kingston, 45, died from a head wound with a gun nearby in the Cotswolds, not deemed suspicious by police

- He was the husband of Lady Gabriella, Prince Michael of Kent's daughter

- His sudden death has deeply shocked both his family and the royal family

Who is Amira Hunter? Woman with eight prior arrests released without bail in Brooklyn

Arizona woman allegedly abducted at gas station in Buckeye| Watch Video

- In Buckeye, Arizona, a woman was abducted at a gas station, caught on video being dragged into a Nissan Rogue

- Police released the footage, urgently seeking information on the victim and assailant

- The public's help is crucial in this alarming assault and abduction case

Who is Alaia Baldwin Aronow? Hailey Bieber’s sister arrested for assault and battery

- Alaia Baldwin Aronow was arrested in Georgia for a bar brawl involving staff assaults and throwing a used tampon

- The incident occurred after she was denied access to an employee bathroom at Club Elan

- She's charged with assault, battery, and trespassing

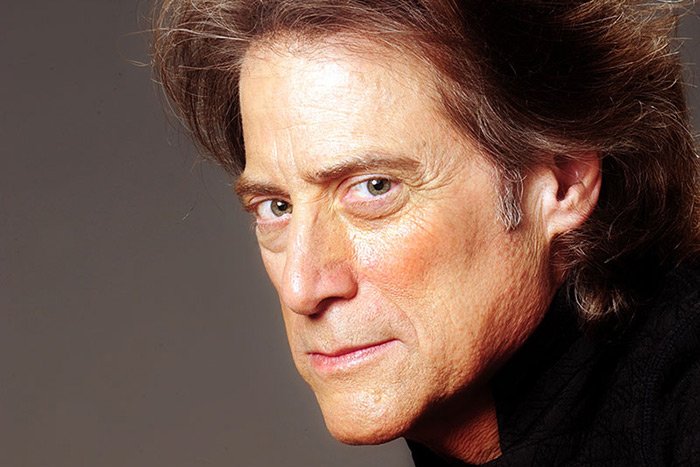

Who was Richard Lewis? Cause of death, age, net worth, wife, career and more

- Renowned comedian Richard Lewis dies at 76

- Lewis leaves behind a comedic legacy spanning decades

- Heart attack claims the life of beloved actor and writer

Who is Tracie R. Porter? Cook County judge orders Illinois Board of Elections to remove Donald Trump from ballots

- Cook County judge orders Trump off Illinois primary ballot

- Legal battle ensues over Trump's eligibility in Illinois

- Judge's ruling adds to debate on Trump's role in Capitol riot

Who was Ivan Cantu? Texas man executed in Collin County for double murder

- Ivan Cantu executed for double murder

- New evidence fails to halt Texas execution

- Controversy surrounds Collin County inmate's case

Dave Myers? Cause of death, age, wife, Hairy Bikers, career and more

- Hairy Bikers' Dave Myers dies at 66

- Myers battled cancer before his passing

- Culinary world mourns loss of beloved chef

Quick Links

Latest News

© Copyright 2022 Opoyi Private Limited. All rights reserved