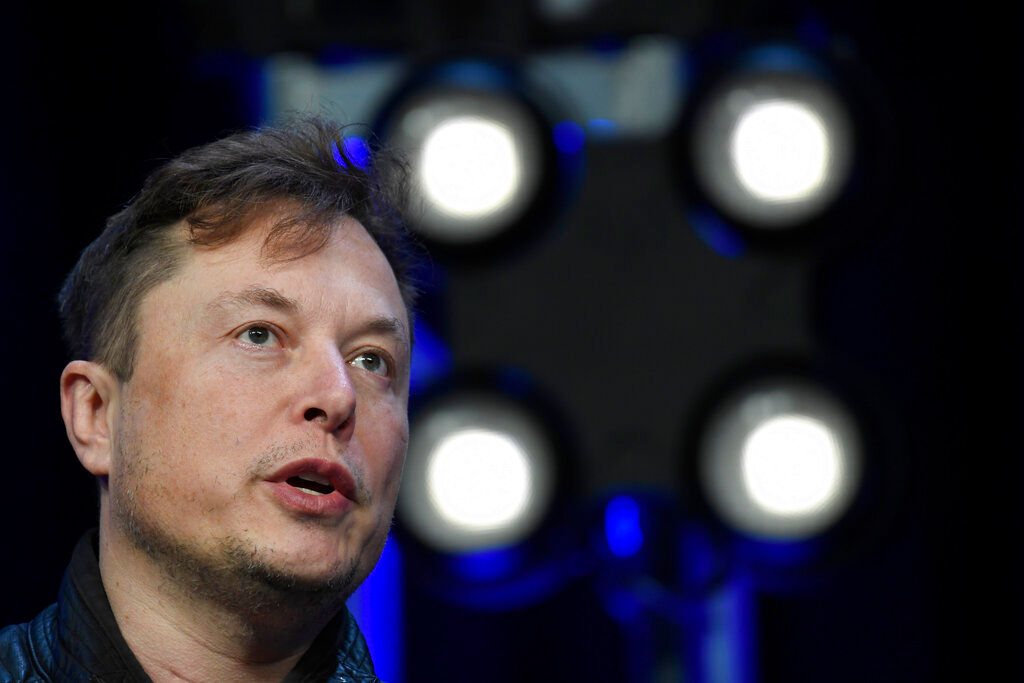

A regulatory filing showed on Thursday that billionaire Elon Musk has offered to acquire a 100% stake in Twitter for $41.39 billion. This comes just days after he said he would no longer be joining the social media company’s board of directors.

Musk currently owns 9.2% of Twitter’s stock and is the company’s biggest shareholder.

On Wednesday, the Tesla CEO provided a letter to the company that contained a proposal to buy the remaining shares. He offered $54.20 per share of Twitter’s stock.

“I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy,” Musk said in the filing.

“However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.”

Also Read: Whiplash for staff on day off as Elon Musk changes mind on Twitter board

Elon Musk was supposed to join the board of the micro-blogging platform on April 9. However, in an unexpected turn of events, Musk decided not to join the board.

Also Read: Elon Musk sued by shareholders over delayed disclosure of Twitter stake

The decision of Musk was made public by the platform’s CEO Parag Agarwal who tweeted, “Elon’s appointment to the board was to become officially effective 4/9, but Elon shared that same morning that he will no longer be joining the board.”

“I believe this is for the best. We have and will always value input from our shareholders whether they are on our Board or not. Elon is our biggest shareholder and we will remain open to his input,” Agrawal said in his tweet.

Also Read: Twitter set for major revamp? Elon Musk’s tweets hint at 4 changes

Agrawal also said that there will be “distractions ahead” but that the goals and priorities remain unchanged.”

“The decisions we make and how we execute is in our hands, no one else’s. Let’s tune out the noise, and stay focused on the work and what we are building.”