Finance Minister Nirmala Sitharaman did not announce any changes in the income tax slabs or regime while presenting the Union Budget 2021 on Monday.

Some of the announcement related to direct taxes made by Nirmala Sitharaman in the Budget speech are:-

– Income tax return filers increased to 6.48 crore in 2020 from 3.31 crore in 2014.

– Serious tax offences of concealment of income of over Rs 50 lakh can be reopened after 10 years.

Live updates: Union Budget 2021

– Senior citizens above 75 years of age with only pension income exempted from filing tax returns.

– Government proposes to make income tax appellate tribunals faceless; to set up national income tax appellate tribunal centre.

– Exemption from tax audit limit doubled to Rs 10 crore turnover for companies doing most of their business through digital modes.

– Advance tax liability on dividend income shall arise only after payment of dividend.

– Tax exemption for aircraft leasing companies; tax exemption for notified affordable housing for migrant workers.

Also read: Gold and Silver to be cheaper, phones to get costlier

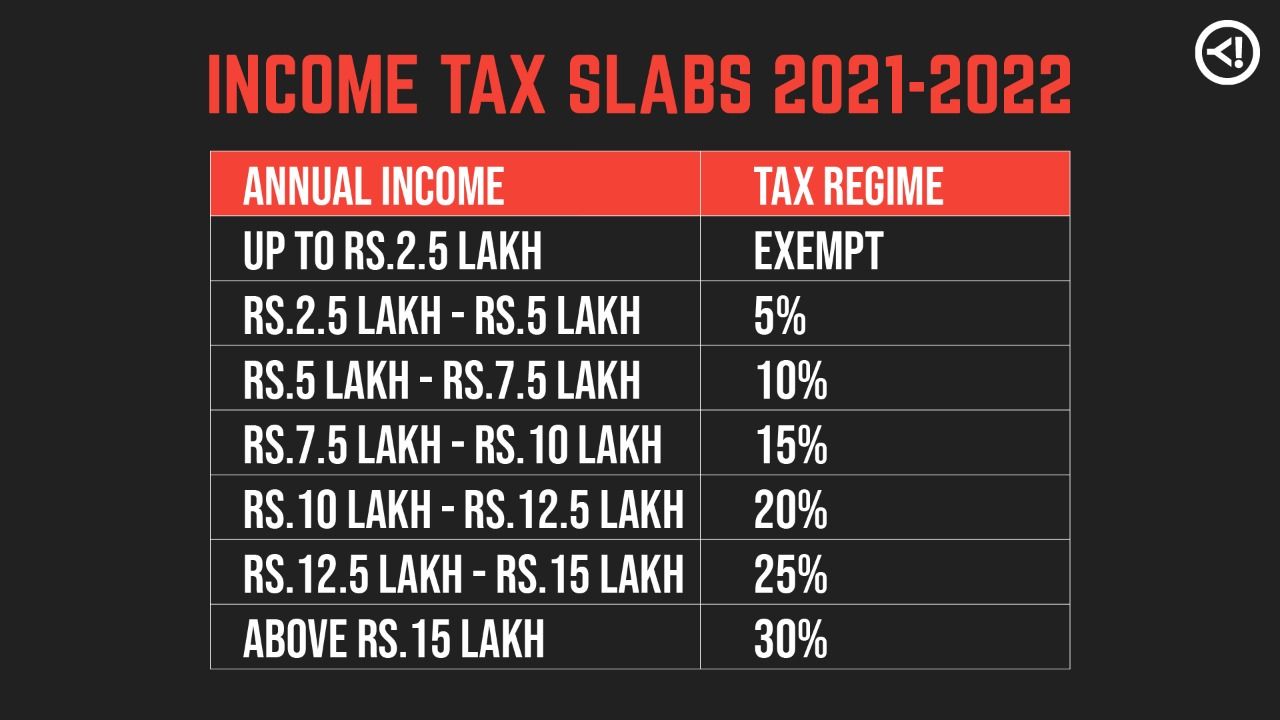

In last year’s Budget, Sithataman had introduced a new tax regime, with an option for the individuals to choose between the old or new system. The new system was a simplified one where one would not be able to add deductions like medical, conveyance etc. Those earning up to Rs 2.5 lakh would be required to pay zero tax, according to this new regime. Those with an income of Rs 2.5 lakh to Rs 5 lakh would be taxed at 5%; 10% for income between Rs 5 lakh and Rs 7.5 lakh. Those with income between Rs 7.5 lakh and Rs 10 lakh would be taxed at 15%.

Also read: Metro Lite, Metro Neo announced for Tier 1 cities, peripheral areas of Tier 1 cities

There is a 20% tax for income between Rs 10 lakh and Rs 12.5 lakh, and 25% for income between Rs 12.5 lakh and Rs 15 lakh. Income above Rs 15 lakh are taxed at the rate of 30%.