Indian economy will grow at more than 7% in the current fiscal year 2022-23, finance secretary TV Somanathan said on Wednesday.

Commenting on the first quarter GDP growth rate of 13.5%, Somanathan said that GDP had exceeded the pre-pandemic level by nearly 4%.

The last time India’s economy grew faster was in the April-June quarter of fiscal 2021-22 when it increased by 20.1% from the pandemic-depressed level a year earlier.

Also Read | India’s GDP Quarter 1 numbers: Sector-wise performance

Manufacturing saw 6.5% growth, the farm sector grew 4.5%, mining sector grew 6.5%, construction sector rose 16.8% and services sector witnessed a growth of 26.3%, according to data released by National Statistical Office (NSO) on Wednesday.

Allying concerns of high imports denting the fiscal architecture, he said the government was on course to meet the fiscal deficit target of 6.4% of GDP in the current financial year ending March 31, 2023.

Also Read | Snapchat decides to layoff 20% of its workforce

The country’s current fiscal deficit is projected at 6.4% of the GDP for the current financial year as against 6.71% for the preceding year.

The Finance Secretary also informed that the government will stick to the current fiscal’s borrowing target. The government plans to borrow Rs 11.6 lakh crore in fiscal 2022-23 to meet its expenditure requirements.

Also Read | India’s GDP grows by 13.5% in Q1; what to expect going forward?

Economic Affairs Secretary Ajay Seth said GST collection for August is likely to remain in the range of Rs 1.42-1.43 lakh crore, signs of buoyancy in the economy.

“Gross fixed capital formation grows 34.7% in April-June, the highest in 10 years,” Seth said.

On cryptocurrency regulations, Seth said that the government expects global dialogue on cryptocurrency to intensify.

Also Read | 3 reasons why India posted double-digit GDP growth in Q1

He added that the volume of e-way bill generation in August registered a year-on-year growth of 15% at Rs 7.56 crore, indicating robust domestic economic activity.

In the April-July period of the current financial year, the fiscal deficit narrowed to 20.5% of the budget estimates as compared to 21.3% in the corresponding period of last year, he said.

Also Read | Reliance Retail buys soft drink brands Campa, Sosyo from Pure Drinks Group

Economists said Asia’s third-largest economy faced downward risks with tighter monetary conditions and higher energy and commodity prices expected to weigh on consumer demand and companies’ investment plans.

India’s economic recovery process would be impacted by a weak labor market recovery and slowing domestic consumption, said Kunal Kundu, an economist at Societe Generale in Bengaluru.

Also Read | Meta announces WhatsApp integration in JioMart after Reliance AGM 2022

“For FY23, we expect the real GDP to grow by 7.1% y/y, though a lower print (rate) would not surprise us,” he added.

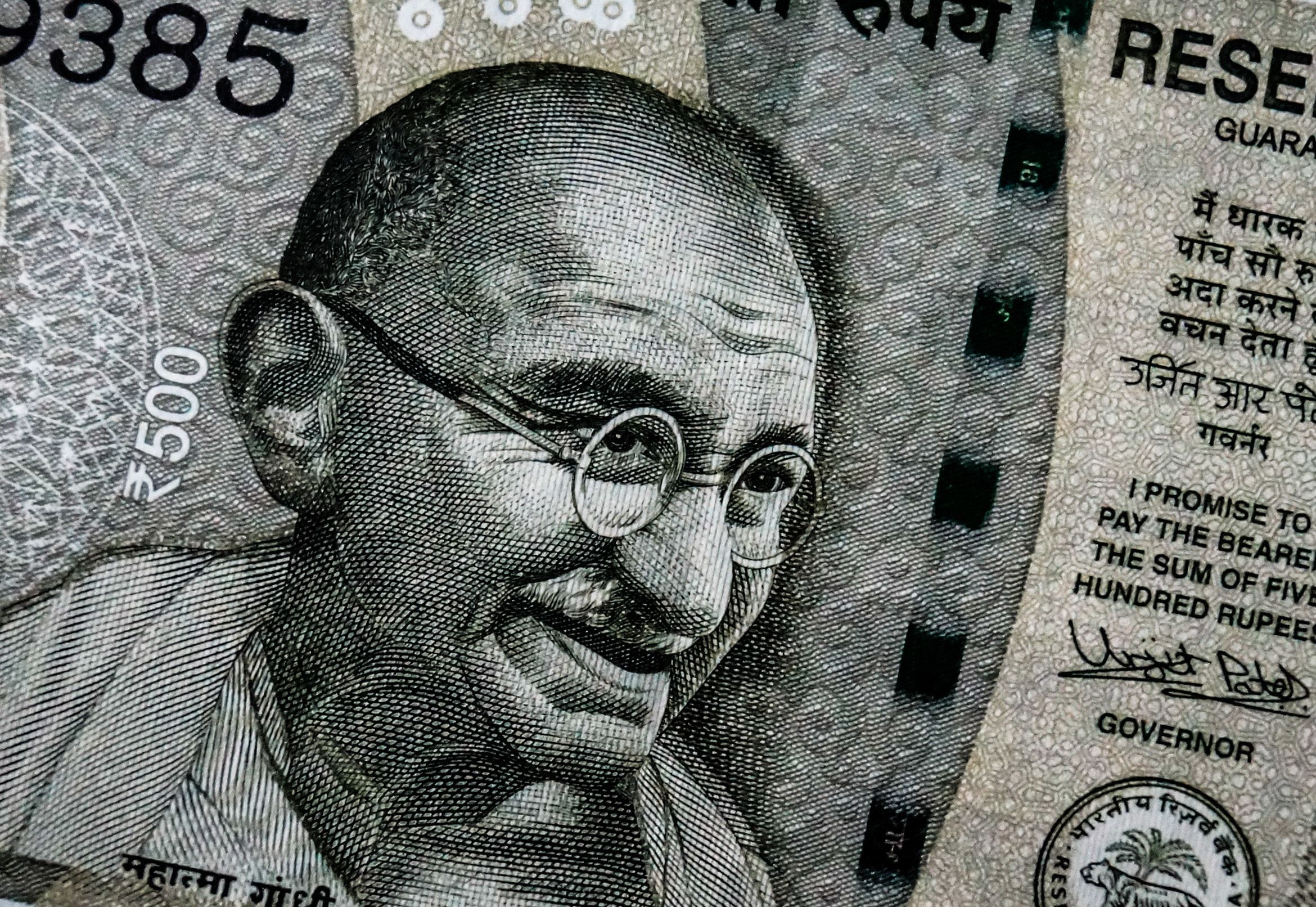

The rupee’s depreciation of more than 7% against the US dollar this year has increased the cost of imported items for consumers and businesses.