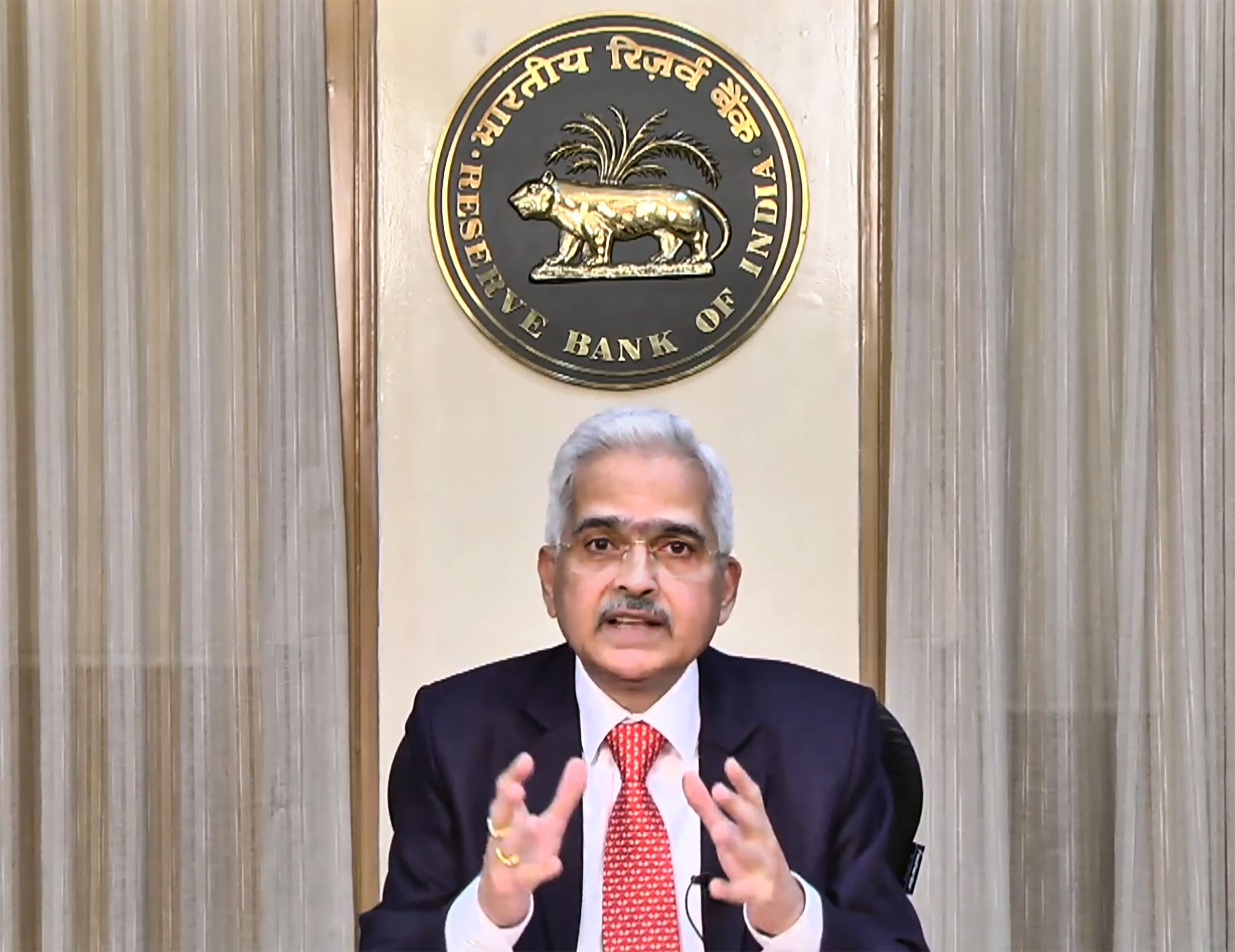

The Reserve Bank of India’s (RBI) Monetary Policy Committee has already begun its three-day meeting, which will come to an end on September 30, Friday. On the day, RBI Governor Shaktikanta Das will announce the central bank’s decisions made during the bi-monthly meeting of the Monetary Policy Committee. The RBI’s rate-setting panel is expected to hike repo rates by 50 basis points. In the last three policy reviews, the RBI’s rate-setting panel has raised 140 basis points in total since May this year.

RBI Governor Shaktikanta Das will make the announcements on Friday, September 30, at 10:00 am IST. His speech and post-policy press conference will be streamed live on various platforms.

Also Read | RBI MPC meet: 50 basis points interest rate hike likely, say economists

“Watch out for the Monetary Policy statement of RBI Governor @DasShaktikanta at 10:00 am on Sept 30, 2022,” wrote the RBI on its Twitter handle.

Post policy press conference will be aired live on Youtube at 12:00 noon on the same day.

The address is also likely to be streamed on the Reserve Bank of India’s Facebook page.

Also Read | Why interest rates are being hiked globally?

Rating agency ICRA expects the MPC to hike interest rates by 50 basis points on Friday and turn data dependent thereafter, taking a cue from the latest CPI figures and the strength of the second quarter growth.

According to the latest data, India’s retail inflation was at 7% in August. While inflation remains high, the Indian rupee is falling sharply, against the US dollar and is currently trading near 82 against the greenback. The rupee depreciation has accelerated following the US Fed raising their interest rate thrice by 75 basis points each in the recent past. Other major central banks also have become aggressive in raising interest rates.

Also Read | How the US Federal Reserve’s rate hike impacts RBI policy

Apart from measures to continue inflation, the RBI is also likely to come out with steps to increase foreign fund inflows to check the declining value of the rupee against the US dollar. Forex reserves have declined by USD 86 billion to USD 546 billion (from their highs last year).

Also Read | Impact of US Federal Reserve rate hike on India

“RBI will need to deploy a combination of measures to balance the trade-offs in its monetary policy objectives, management of interest rates, the rupee, and system liquidity, which can minimize the growth sacrifice ratio even while gradually reverting the CPI inflation trajectory to near the 4% target,” said Saugata Bhattacharya, Chief Economist at Axis Bank.