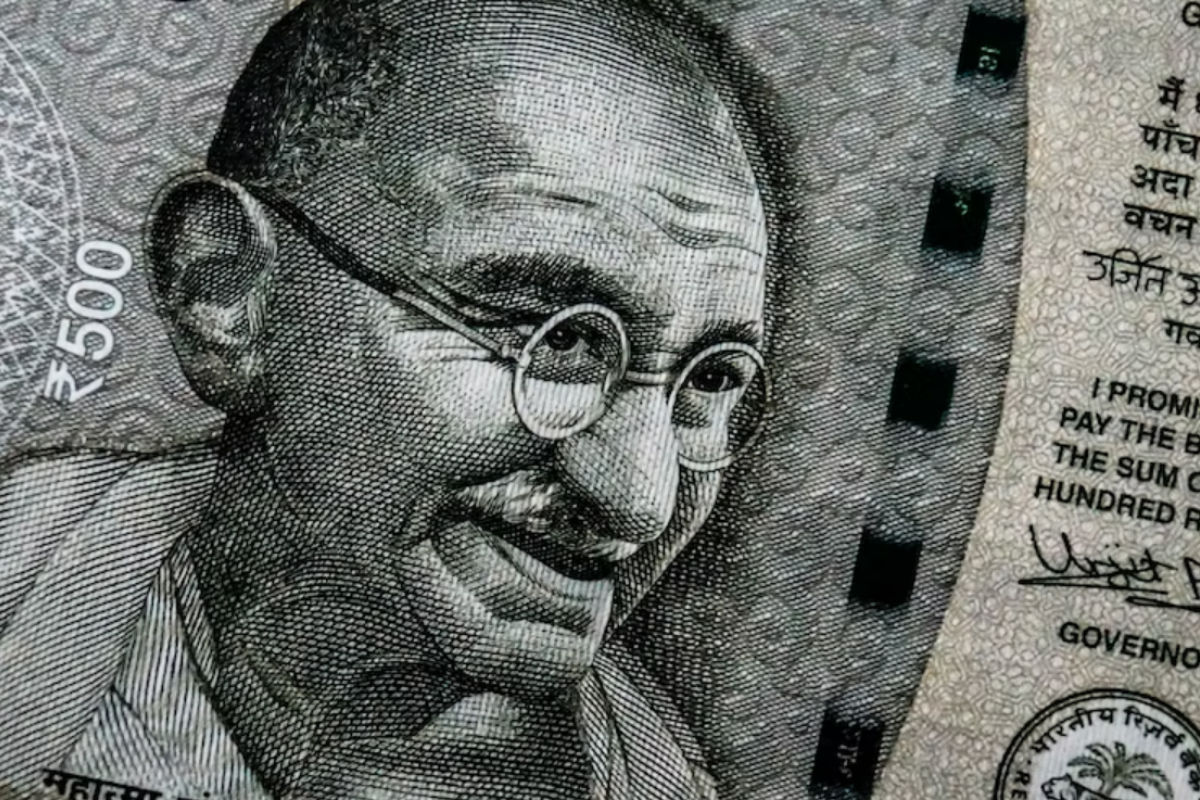

The rupee gained 45 paise to settle at 81.90 against the US dollar on Monday, on the back of consistent foreign fund inflows and weakening US currency.

The local currency began stronger at 82.14 against the US dollar at the interbank foreign exchange market. It recorded a high-low of 81.90 and 82.32 on Monday. It finally closed 45 paise lower at 81.90 against the US dollar.

Also Read: SBI shares jump 5%, hits record high after strong Q2 performance

“Indian Rupee appreciated as US Dollar weakened and domestic markets ended higher. Asian markets also ended higher today following a surge in US and European markets on Friday,” said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

“Market participants may remain cautious ahead of inflation data from the US later this week. The USD-INR spot price is expected to trade in a range of Rs 81.25 to Rs 82.80,” Choudhary said.

Also Read: Twitter delays launch of $8 subscription plan for blue ticks until end of midterms: Report

The rupee fell 53 paise to settle at 82.35 against the dollar in the previous session on Friday.

The dollar index, which measures the US Dollar’s strength against a basket of six currencies, rose by 0.31% to 110.52.

Concurrently, Brent crude futures, the international oil benchmark fell 0.41% to $98.17 per barrel.

Also Read: US employers add 261,000 jobs in October, unemployment rate up at 3.7%

Gold prices on the Multi Commodity Exchange (MCX) jumped on Monday, November 07, 2022, at around 5:40 pm. Gold futures were trading at Rs 50,927 per 10 gm, up 61 points or 0.12%, in the Indian market. Silver futures were trading at Rs 60,594 per kg, up 56 points or 0.09%.

Copper futures were trading at Rs 674.50 down 1.11% while Natural Gas and Aluminium futures were trading at Rs 574.70 per MMBtu and Rs 205.30 per Kg respectively on MCX.

Also Read: Britannia, SBI, Marico and other stocks that moved most on November 7

The BSE Sensex rose 234.79 points or 0.39% to end at 61,185.15 on the domestic stock market, Similarly, the NSE Nifty gained 85.65 points or 0.47% to settle at 18,202.80.

According to exchange data, foreign Institutional Investors (FIIs) were net buyers in the equity markets as they purchased shares worth Rs 1,436.25 crore, while Domestic Institutional Investors sold shares worth Rs 548.59 crore on Friday, November 04, as per data available on NSE.