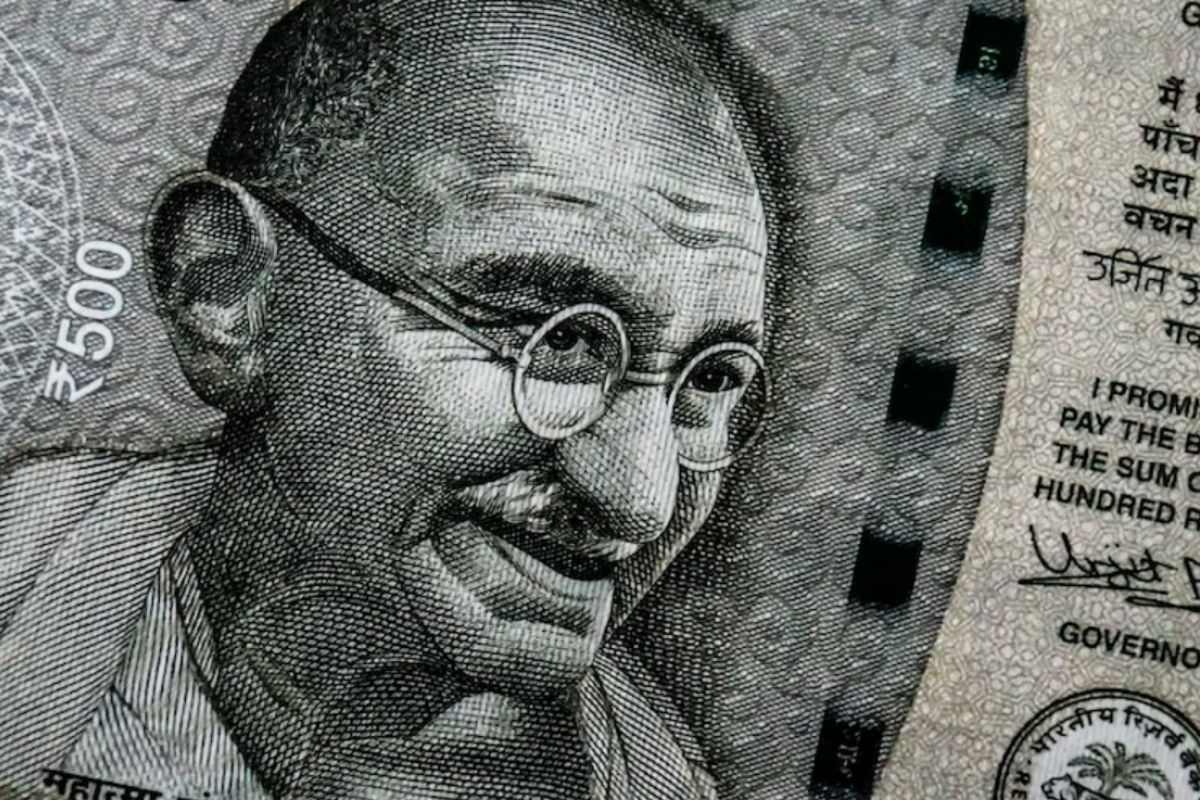

The rupee fell 34 paise to settle at 81.25 against the US dollar on Wednesday after foreign fund outflows in domestic equity markets. India’s exports entered red territory after a gap of about two years, declining sharply by 16.65% to USD 29.78 billion in October, widening the trade deficit to USD 26.91 billion.

Also Read: Bikaji, Metropolis, Nykaa and other stocks that moved most on November 16

The local currency began weaker at 81.41 against the US dollar at the interbank foreign exchange market. It recorded a high-low of 81.23 and 82.58 on Wednesday. It finally closed 34 paise lower at 81.25 against the US dollar.

“The Indian rupee depreciated on risk aversion in global markets and weak Asian currencies. Disappointing macroeconomic data from FII outflows also weighed on Rupee,” said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

Also Read: Gold, silver, and other metal prices on Wednesday, November 16, 2022

“We expect Rupee to trade with a negative bias on risk aversion in global markets and Dollar demand from importers. However, a weak Dollar and decline in crude oil prices may prevent a sharp fall in the rupee,” Choudhary said.

The rupee gained 37 paise to settle at 80.91 against the dollar in the previous session on Tuesday.

Also Read: Oil prices fall as dollar gains in strength allaying supply fears

The dollar index, which measures the US Dollar’s strength against a basket of six currencies, fell by 0.28% to 106.10.

Concurrently, Brent crude futures, the international oil benchmark rose 0.47% to $94.30 per barrel.

Gold prices on the Multi Commodity Exchange (MCX) appreciated on Wednesday, November 16, 2022, at around 5:30 pm. Gold futures were trading at Rs 53,179 per 10 gm, up 434 points or 0.82%, in the Indian market. Silver futures were trading at Rs 62,113 per kg, up 1,223 points or 1.99%.

Also Read: RBI shortlists five banks to work on digital currency pilot project

Copper futures were trading at Rs 691.85 down 0.26% while Natural Gas and Aluminium futures were trading at Rs 488.40 per MMBtu and Rs 209.35 per Kg respectively on MCX.

The BSE Sensex closed 1107.73 points or 0.17% higher at 61,980.72 on the domestic stock market, Similarly, the NSE Nifty was higher by 6.25 points or 0.03% to 18,409.65.

Also Read: Warren Buffett’s Berkshire picks $4.1 billion stake in chip giant TSMC

According to exchange data, foreign Institutional Investors (FIIs) were net sellers in the equity markets as they sold shares worth Rs 221.32 crore, while Domestic Institutional Investors (DIIs) sold shares worth Rs 549.28 crore on Tuesday, November 15, as per data available on NSE.