Spirit Airlines (SAVE)

Spirit Airlines lost 4.7% in premarket trading after saying it would accept the latest improved takeover bid from Frontier Group (LLC). The latest Frontier cash-and-stock bid is valued at $2.7 billion based on Friday’s closing prices, while the most recent JetBlue (JBLE) all-combination with JetBlue, a notion that JetBlue has disputed. Frontier fell 1.7% while JetBlue remained unchanged.

Also Read | Four G7 nations to ban Russian gold: How it impacts oligarchs, Moscow

Coinbase (COIN)

Shares of the cryptocurrency exchange fell 5.3% in the premarket after Goldman downgraded it to “sell” from “neutral,” pointing to the continued fall in crypto prices and slower industry activity levels.

Also Read | Why Sri Lankan government is sending 2 ministers to Russia amid fuel crisis

BioNTech (BNTX)

BioNTech surged 2.1% in premarket action after the drug maker and partner Pfizer (PFE) said their omicron-based Covid-19 booster shots showed an improved immune response against the variant.

Also Read | What G7 said about the Russia-Ukraine conflict

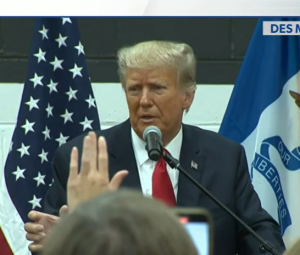

Digital World Acquisition (DWAC)

The stock fell 5.8% in the premarket. In an SEC filing, the SPAC linked to former President Donald Trump’s media company said additional subpoenas were issued in an ongoing probe of its registration of the proposed business combination. Digital World said the investigation could materially impede, delay or even prevent the combination from being consummated.

Also Read | Four G7 nations to ban Russian gold: How it impacts oligarchs, Moscow

Robinhood Markets (HOOD)

Robinhood jumped 2.5% in the premarket after Goldman Sachs upgraded the trading platform operator’s stock to “neutral” from “sell” although it slashed the price target to $9.50 per share from $11.50. The surge comes despite the release of a Congressional report detailing the platform’s difficulties in handling the meme stock frenzy of January 2021.

Also Read | China keeps temporarily banning Tesla cars: Here’s why

Altria (MO)

Altria added 1% in premarket action after Juul won a temporary stay of the FDA ban on its e-cigarette products. Altria owns a 35% stake in Juul.

Newmark Group (NMRK)

Shares of the commercial real estate firm rose 1.6% in premarket action after the New York Post reported on a possible merger between Newmark and rival Cushman & Wakefield.

Also Read | How Lizzo is coming to the rescue of abortion rights groups

Chewy (CHWY)

Chewy soared 4.1% in the premarket trading after Needham upgraded the stock to “buy” from “hold,” saying that price increases for the pet products retailer are sticking and that supply chain issues are improving.

Also Read | List of all companies providing abortion travel benefits to US employees

AutoZone (AZO)

Shares of the auto parts retailer gained 1.9% in the premarket after Goldman Sachs upgraded to “buy” from “neutral,” saying it is a good defensive play as the vast majority of auto parts sales are non-discretionary and demand remains relatively inelastic.

Walgreens (WBA)

Walgreens surged 1% in premarket action as India-based conglomerate Reliance Industries is reportedly in talks with global lenders to raise $8 million to finance the purchase of Walgreens’ Boots drugstore chain.