US equities rose slightly on Monday, as Wall Street continues to debate whether the economy can escape a recession in the face of increasing interest rates and soaring inflation.

Also Read| Trade Setup: Top 15 things to know before market opens on June 7, 2022

The S&P 500 gained 12.89 points, or 0.3%, to 4,121.43 following another day of wild swings, as has become usual for markets. The Dow Jones Industrial Average rose 16.08 points, or less than 0.1%, to 32,915.78, while the Nasdaq Composite increased 48.64 points, or 0.4%, to 12,061.37.

Also Read| Trending Stocks: SBI, Adani Entp, Tata Motors and others in news today

Stocks began the day with larger gains, with the S&P 500 up as much as 1.5% and the Nasdaq momentarily up about 2%. But they fell back as Treasury yields continued to climb, putting downward pressure on stocks. When safe bonds are paying more in interest, investors are usually less willing to pay high prices for stocks, which are riskier.

Also Read| US Stock Market: DJIA, S&P500 and Nasdaq turns green in early trade on Monday

The yield on the 10-year Treasury jumped back above 3% to 3.04%, up from 2.95% late Friday. It’s moving toward its levels from early and mid-May when it reached its highest point since 2018 amid expectations for the Federal Reserve to raise interest rates aggressively in order to rein in the worst inflation in decades.

Also Read| US Premarket: Apple, Spirit, Revlon and other stocks making biggest moves

Stocks in Shanghai rose 1.3%, Hong Kong’s Hang Seng jumped 2.7% and Germany’s DAX returned 1.3%.

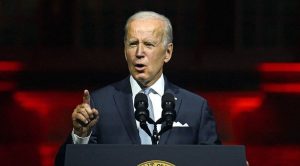

On Wall Street, companies in the solar power industry were some of the biggest gainers after President Joe Biden ordered emergency measures to increase U.S. manufacturing of solar panels and exempted panels from Southeast Asia from tariffs for two years.

Enphase Energy jumped 5.4%, and SolarEdge Technologies rose 2.9%.

Also Read| Oil India, LIC, PVR and other stocks that moved most on June 6

Amazon was one of the biggest forces pushing the S&P 500 higher. It rose 2% after splitting its stock, 20-for-1. Such a move lowers its stock price and makes it more affordable to some smaller-pocketed investors, all while leaving its total value alone.

Also Read| Liquidity tightening expected with RBI rate hike on June 8

Spirit Airlines rose 7% after JetBlue Airways boosted its buyout offer in the bidding war for the discount carrier.

Also Read| Week ahead: RBI policy, global indications to weigh on Sensex, Nifty

On the losing side was Twitter, which slipped 1.5% after Tesla CEO Elon Musk threatened to call off his deal to buy the company, saying Twitter was refusing to hand over data. Musk has been complaining about how many of Twitter’s users are actually bots and fake accounts. The shares of Tesla rose 1.6%.