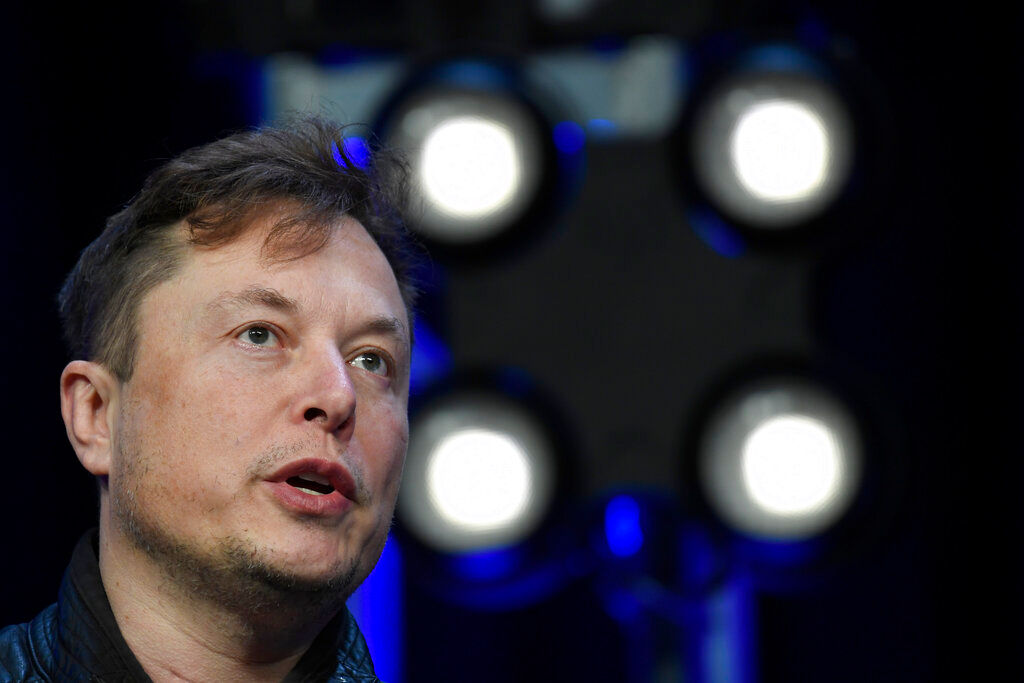

Court filings have revealed that SpaceX and Tesla founder Elon Musk, now also the owner of Twitter, had a feud with Saudi Arabia’s sovereign wealth fund over the latter’s failure to publicly back Musk in his quest to take Tesla private in 2018.

The texts came to light in court filings for a fraud case against Musk wherein he stands accused of defrauding Tesla investors by tweeting in August 2018 that he had “funding secured” to take the electric vehicle manufacturer private.

The now available texts show that Musk, the world’s richest man, was irate with the Saudi Public Investment Fund (PIF) for not making public its interest to help take Tesla private.

Also read | Elon Musk outlines vision for Twitter, wants his ‘worst critics’ to stay

“You said you were definitely interested in taking Tesla private and had wanted to do so since 2016,” Musk told PIF manager Yasir Al-Rumayyan, adding, “I’m sorry, but we cannot work together.”

The Tesla founder also sent Al-Rumayyan a Bloomberg article on how the PIF was “in talks” to take Tesla public, saying, “I read the article. It is weak sauce and still makes me sound like a liar. It is filled with equivocation and in no way indicates the strong interest you conveyed in person.”

“You said that you were the decision-maker for PIF, that you had wanted to do the Tesla take private deal for two years, and that this was supported directly by the Crown Prince,” a furious Musk told Al-Rumayyan.

Also read | SpaceX’s Starlink inks in-flight WiFi deal with Hawaiian Airlines

“You are throwing me under the bus,” the 50-year-old billionaire added later.

The PIF governor, however, was unmoved by Musk’s wrath and told the billionaire that continued cooperation between the fund and Musk’s companies was contingent on the South Africa-born entrepreneur’s decision: “It’s up to you Elon,” Al-Rumayyan replied.

The spat between Musk and the PIF sheds further light into what led to the collapse of the billionaire’s quest to take Tesla private, which he abandoned in late-August 2018. The PIF, meanwhile, 99.5% of its Tesla holdings in 2019, a year before Tesla share prices soared.