Zilingo was once seen as Southeast Asia’s next big unicorn, but the myth built around the fashion ecommerce startup has turned to dust as a months long investigation by Bloomberg has exposed the reality of the company that was valued at $970 million in 2019.

Here is a timeline of Zilingo’s rise and fall:

2015:

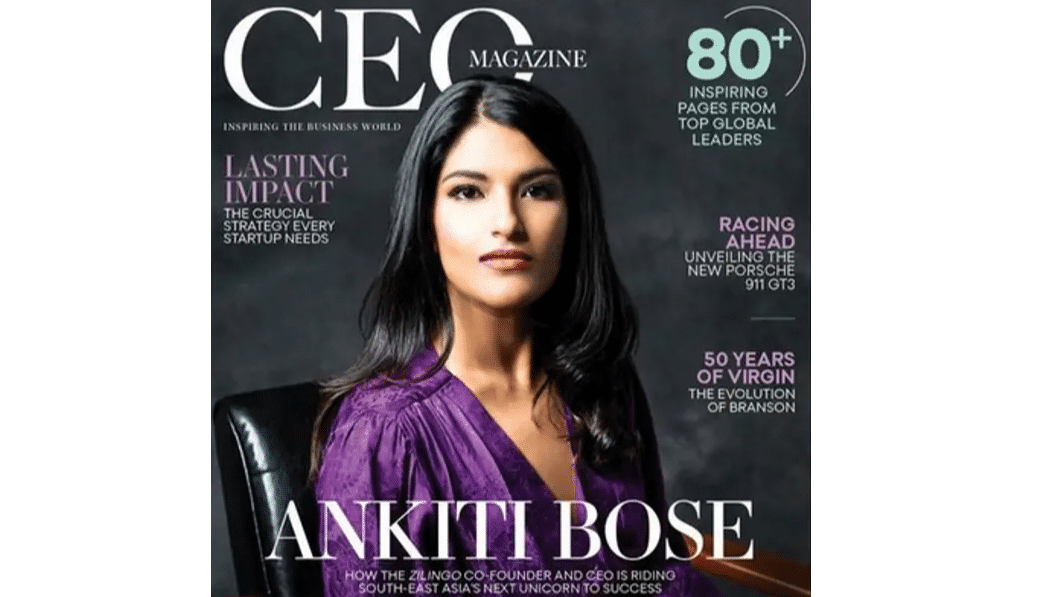

Founder and CEO Ankiti Bose along with Dhruv Kapoor found Zilingo after the former saw a chance to disrupt the Southeast Asian market by helping small fashion retailers get online.

The company acquires seed funding from Sequoia Capital India, the Indian arm of the venture capital firm from Silicon Valley that has helped fund the likes of Google, Instagram, LinkedIn, PayPal and Zoom. Sequoia would continue to be a part of Zilingo’s funding rounds until 2019.

Also Read: Zilingo’s COO resigns as company flounders

2016:

Sequoia funds the Series A round and provides the termsheet. Zilingo now has funding worth $8 million. Bose moves to Singapore to work on the companies software and supply chain solutions.

2017:

Bose realises that her business model of platforming small businesses isn’t working. Zilingo switches to a busines-to-business model where they connect small manufacturers and wholesalers to small retailers so they can work out a deal together, with the ecommerce platform taking a cut. Sequoia funds their Series B round and Zilingo gets $18 million to continue growing their product.

2018:

The company raises $54 million in Series C funding from Sequoia. The company makes a couple of mistakes:

A) It sets aside $1 million of its $10 million marketing budget for a three-day trip to Morocco for nine social influencers. #ZilingoEscape was supposed to bring in 1 million users per dollar spent, according to the Bloomberg report. The expensive three-day affair ended up attracting only 10,000 new users.

B) The company began providing loans to suppliers and vendors in need of capital injection. Bose directed her teams to increase the number of loans given out each month. Two years later, the company is forced to write off the debt it is owed as the COVID-19 pandemic decimates small businesses and startups.

2019:

Sequoia funds Zilingo’s Series D round, and the company manages to raise $226 million at a $970 market evaluation. The company manages to wrangle James Perry, the former managing director and APAC head of tech investment banking for Citigroup joins the company as Chief Financial Officer.

The company announces a $100 million foray into the American market to capitalise on the US-China trade war.

In October, the company’s board of directors directs Bose to reduce cash burn. It is revealed the company is burning through $7 million to $8 million a month. In a statement to Bloomberg in 2022, Bose says that she had reduced cash burn by 70% between the end of 2019 and 2021.

2020:

Zilingo manages to get funding from Singapore government-backed Temasek Holdings and The Singapore Economic Development Board. On the onsent of the pandemic, the company signs a contract with the Indian government to supply 10 million KN-95 masks for 22.5 million. Six months later, the Indian government claims 3.2 million masks weren’t delivered sparking a legal battle. The lawsuit is ongoing.

In September, Fred Perry leaves the company, returning to Citigroup.

In November, it is revealed the company has just enough to last a month. Existing investors including Sequoia, Temasek, Safina, and SIG Venture Capital step in, providing $25 million in short-term debt financing to Zilingo.

2021:

Sequoia Capital’s Managing Director, Shailendra Singh, sits down with Bose to talk options and suggests stepping aside to let someone more experienced take the reigns. Bose refuses. The year is spent searching for more funding. Two investment firms, Indies Capital Partners and Varde Partners pour in a combined $40 million in mezzanine debt (a hybrid of debt and equity backed by value of the company’s cash flows). Other attempts at raising money from venture capital firms and private equity firms fail.

According to the Bloomberg report, two firms backed out after finding proof of merchant fraud in Indonesia, which accounts for more than half of Zilingo’s gross merchandise value (the total value of merchandise sold by a company).

2022:

Bose is called into an investor meeting in Singapore in March, 2022. The Bloomberg report says that the Zilingo board had received complaints about “alleged mismanagement and financial misrepresentation”. Bose is suspended until further notice. The company hires investigators to audit the finances.

Irregularities are found in the revenue numbers of the 2021 financial year. Three numbers were shared according to the Bloomberg report: $190 million, $140 million and $164 million.

Bose claims the $190 million was the number distributed before the year end and the cancellation of orders. $140 million was the due diligence report for fundraising. $164 million was the revenue, including uninvoiced revenue.

Bose is fired on May 20, 2022.

On June 20, 2022, Kapoor and Bose offer the board a management buyout plan which would let them keep Zilingo’s important assets like the digital platforms and the factory, which liquidating all other assets to pay off debtors. As part of the deal, a new investment group will provide $8 million in capital injection.

On July 29, 2022, the long time Chief Operating Officer Aadi Vaidya resigns.