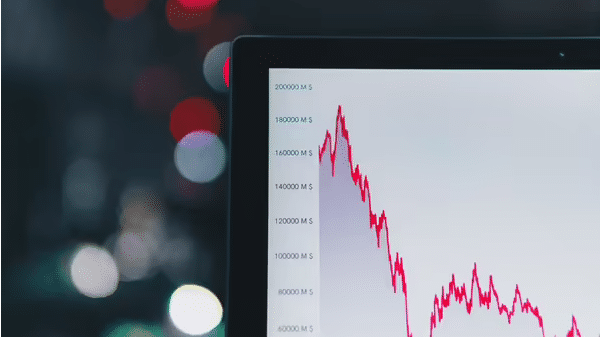

Cement company Ambuja Cements slipped 5.2% to Rs 341.2 per share in early trade at 10:55 am on Friday after it announced its quarterly earnings for the October-December 2021 quarter.

Ambuja Cements follows a January to December financial year. It posted a standalone net profit of Rs 251.66 crore, a 49.4% year-on-year decline. Its consolidated net profit dropped 55.5% to Rs 431 crore from Rs 968.24 crore in the quarter a year ago.

Also Read | Coal India, Ambuja Cements and other stocks that moved most on February 18

The consolidated net profit in calendar year 2021 surged 19.4% year on year to Rs 3,711.07 crore.

Ambuja Cements in a BSE filing reported a 2.31% jump in revenue from operations to Rs 7,625.28 crore from Rs 7,452.87 crore in the year-ago period. Its standalone revenue from operations stood at Rs 3,735.12 crore as against Rs 3,515.11 crore in the corresponding quarter last year.

Also Read | Closing Bell: Sensex drops 60 points, Nifty closes at 17,276

The company’s total expenses stood at Rs 6,865.61 crore in the December 2021 quarter, a 6.7% jump as compared with Rs 6,434.43 crore a year ago.

EBITDA stood at Rs 568 crore in the reported quarter, down 26% year on year from Rs 768 crore. EBITDA margin contracted to 15.2% sequentially from 21.8%.

Also Read | Top 5 cryptocurrencies of the day: BTC up by 6%, TRX trends at no. 1

The cement company’s consolidated result includes the financial performance of its subsidiary company ACC Ltd.

Ambuja Cements’ sales volume stood at 7 million tonnes in the quarter.

The company’s board of directors recommended a final dividend of Rs 6.30 per share, subject to approval of the shareholders at the ensuing annual general meeting. The dividend will be paid after April 29, 2022, the company said.

Also Read | Tesla need to buy $500 million of local auto parts to avail tax cut: Report

The board also approved an investment of Rs 3,500 crore for a cement grinding expansion plan of potential 7 million tonnes across its grinding units at Sankrail and Farakka and a Greenfield location at Barh in Bihar. It will be supported by 3.2 million tonne brownfield clinker expansion at its integrated plant in Bhatapara, Chhattisgarh.

Also Read | Tatas will make Air India world-class airline: CEO N Chandrasekaran

On February 18, the stock closed at Rs 338.92, down by 21.30 points or 5.92%, on the National Stock Exchange.