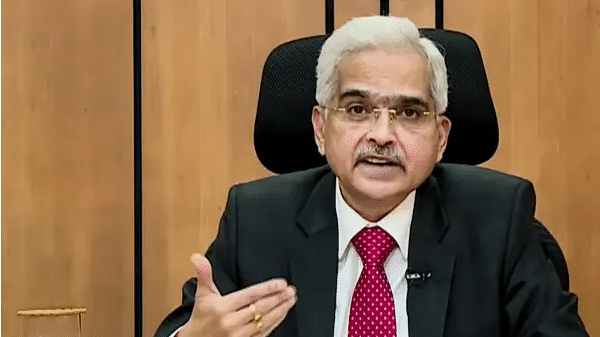

The Reserve Bank of India’s Monetary Policy Committee, led by RBI Governor Shaktikanta Das, unanimously hiked the repo rate by 50 basis points to 4.90%. The latest policy rate hike follows the central bank’s announcement of a 40 basis point increase in the repo rate in off-cycle policy action in May. The monetary policy committee’s decision was unanimous and it has decided to keep the stance of “withdrawal from accommodative”.

Also Read | RBI MPC meet: 10 highlights from Shaktikanta Das’ speech

Consequently, the standing deposit facility (SDF) rate is adjusted to 4.65% and the marginal standing facility (MSF) rate and the Bank Rate to 5.15%. The decisions are following the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% with a margin of 2% on either side while supporting growth.

Also Read | How inflation affects RBI’s interest rate policy

Here are the top highlights of RBI Governor Shaktikanta Das’ press conference:

1. “RBI cannot give any forward guidance in such a volatile situation,”

2. Talking about inflation, Das said, “We have revised our projection for inflation at 6.7% for this year. Around 75% of the increase in inflation projections can be attributed to food inflation”.

Also Read | RBI MPC meet: Central bank raises inflation projections above 6%

3. “We remain committed towards bringing down inflation. We believe our action will help in bringing down inflation and inflation expectations. Future rate actions will depend on evolving conditions. The target of 4% does remain”.

4. Das said, “We do not want to take any abrupt, rough action that will be detrimental for inflation and markets of to the credit. We are focussed on withdrawal of accommodation but still below the pre-pandemic level.”

Also Read | RBI MPC meet: Real GDP growth projections for FY 2022-2023 retained at 7.2%

5. “Liquidity withdrawal will be calibrated and measured in future, and we will ensure that adequate liquidity remains available to meet banks’ requirements. If the liquidity runs into a very heavy deficit, a repo window is always available. That can be used by the system”.

6. On interest on bank deposits, Das said, “Going forward we do expect the rate hikes to get transmitted also to the liability side, namely in the deposit rates.”

Also Read | RBI MPC meet: Home loan EMIs to get costly as central bank hikes repo rate

7. “Indian economy continues to be resilient, is well placed to deal with challenges emanating from global issues.”

8. “Normal capital inflows will help manage current account deficit; gap will remain at sustainable levels.”

9. On cryptocurrency, Das said, “there is constant engagement between the RBI and the government. We have given our views to the government. Let us wait for the consultation paper to come out.”

Also Read | RBI MPC meet: Co-operative banks’ housing loan limits hiked by 100%

10. “Linking credit cards to UPIs gives customers a greater choice of the payments, though the pricing aspect needs to be worked out,” said Deputy Governor Rabi T Shankar.

11. On tokenisation, Deputy Governor Shankar said, “The progress (on tokenisation) has been satisfactory and about 16 crore tokens have already been issued.”