The Punjab National Bank fraud, dubbed as the biggest scam in India’s banking history, came to light in 2018. The case started off as a Rs 2.8 billion-fraud, according to the first police complaint, but within months ballooned into a Rs 13,500 crore mega scam at the Centre of which were diamantaires Nirav Modi and his uncle Mehul Choksi.

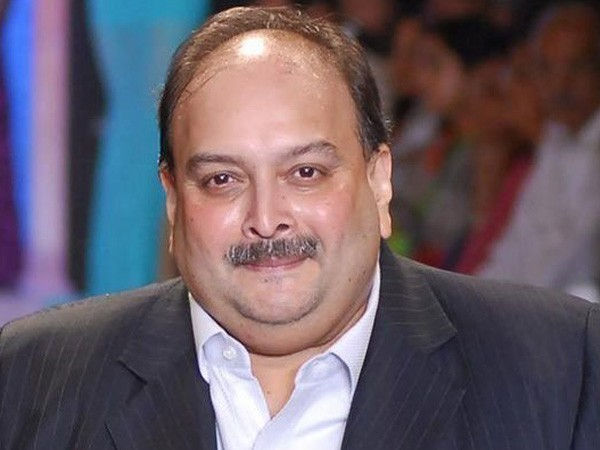

Both the prime accused fled the country soon after and while Modi awaits extradition from the UK, Choksi has gone missing from Antigua and Barbuda, where he had taken refuge. Here is all about the case and the main accused:

What is the fraud?

The Punjab National Bank fraud involves the issuing of fake letters of undertaking worth ₹13, 500 crore by the bank’s Brady House branch in Fort, Mumbai. The fraud was allegedly masterminded by jeweller and designer Nirav Modi, nephew of Mehul Choksi.

Who are the key accused in the case?

The key accused in the case are diamantaire Nirav Modi, 50, his maternal uncle Mehul Choksi, 62, and other relatives and some PNB employees.

Where are the key accused?

Nirav Modi and his family, which owns Firestar Diamond International and A. Jaffe Inc., fled the country in early 2018. In April this year, the United Kingdom home ministry okayed his extradition to India.

In 2017, Mehul Choksi, owner of Gitanjali Gems, took up the citizenship of the Caribbean nation of Antigua and Barbuda under the Citizenship by Investment Programme and has been in that country since. In March this year, Antigua initiated the process to cancel Choksi’s citizenship but he had challenged the government’s move in court.

How was the ₹13,500-crore scam perpetrated?

In a criminal complaint filed by the PNB, it was alleged that two junior employees at its Brady House branch in Mumbai, in collusion with companies belonging to Modi and Choksi, issued fraudulent “letters of undertaking” without asking for any margin money as security.

The firms, the complaint adds, raised short-term credit from overseas branches of other Indian banks based on these LoUs. Also, fraudulent foreign letters of credit (FLCs) were raised in favour of foreign suppliers, in some instances

This guideline was ignored by overseas branches of Indian banks. They failed to share any document/information with PNB. The information, it came to light, was not shared by the firms with them.

Nirav Modi got the first fraudulent guarantee from PNB on March 10, 2011, and managed to get 1,212 more such guarantees over the next 74 months.

The enforcement agency has so far seized movable and immovable properties to the tune of Rs 2362 crore in the PNB fraud case.

How was the scam exposed?

The first complaint in the case was filed by PNB on January 29, 2018. It stated that fraudulent LoUs worth Rs 2.8 billion were first issued on January 16. The PNB had named three diamond firms, Diamonds R Us, Solar Exports and Stellar Diamonds. Then the magnitude of the scam started unfolding. Within three months, the scam has ballooned to over Rs 11,000 crore.