Several reasons, including more business adoption and increased demand from Bitcoin ETFs, promote rising Bitcoin prices. Market analysts anticipate that Bitcoin will reach $100,000 by the end of 2023, although numerous others believe it will happen in Q1 2022. Others are cautious to pick a precise date or year, predicting that Bitcoin would not be worth more than US$70,000 by the end of 2022.

Also Read| Coal India share surges over 4% on increase in production reports

Bitcoin dipped below the 200-day simple moving average (SMA) ($47,259) on Dec. 17 but the bears could not build upon their advantage and extend the decline further. This shows that selling dried up at lower levels.

The bulls pushed the price back above the 200-day SMA on Dec. 21 but the recovery is facing resistance at the 20-day exponential moving average (EMA) ($49,517). This indicates that bears have not yet given up and are selling on rallies.

Also Read| Stock market midday report: Sensex up 604 points, Nifty around 17,500

If the price turns down from the current level, the bears will again try to sink the price below the 200-day SMA and extend the decline to the strong support zone at $42,000 to $39,600.

Conversely, if bulls drive the price above the 20-day EMA, the BTC/USDT pair could rise to $52,000. This level may act as a barrier but if bulls thrust the price above it, the rally could reach the next major hurdle at $60,000.

Also Read| Eicher Motors rallies 5% on strong sales data for December

Bitcoin fear and greed index on Monday, January 3, 2022, went from the fear level of 28 to the level of 29 as per the alternative. me. The Fear and Greed index is a technique for assessing investors’ emotions toward the market.

Bitcoin is currently trading around $47,028.23, down 0.43%. In the last 24 hours, the highest it touched was $47,881.41 and the lowest was $46,807.59. Bitcoin has a current market cap of $889,420,163,196. It has a circulating supply of 18,918,568.00 BTC coins and a maximum supply of 21,000,000 coins.

Also Read| China Evergrande shares suspended, set to release ‘inside information’

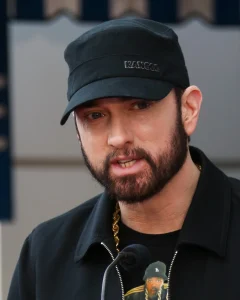

Eminem acquires Bored Ape Ethereum based NFT for $450K

Eminem, the legendary Detroit rapper, has aped into the Bored Ape Yacht Club (BAYC). On Thursday night, he paid 123.45 ETH ($452,000) to buy one of the Ethereum-based Apes and has since made the ape his Twitter profile photo. Meanwhile, he appears to have amassed at least 15 NFTs on OpenSea under the alias Shady Holdings. GeeGazza, a fellow BAYC member, sold the blonde ape to Eminem, stating that the sale becoming a reality is “madness” and that “I’m living in a simulation.” Eminem has yet to make a public statement on the sale. Eminem has joined a long list of celebrities who have aped, including NBA player Stephen Curry and talk show host Jimmy Fallon.

Also Read| US Stock Market: DJIA, S&P500, Nasdaq and Russell ended with small losses

Major cryptocurrency exchanges in India raided by Tax officials

India’s tax authorities have conducted searches at some of India’s biggest cryptocurrency exchanges including CoinSwitch Kuber, CoinDCX, BuyUCoin and Unocoin after what they deemed tax evasion of Rs 40.5 crore (400 million INR or approximately $6 million) was detected at cryptocurrency exchange WazirX, according to sources with direct knowledge of the searches. On Dec. 31, the tax authority revealed details in a statement saying “the case is a part of the special anti-tax evasion drive, which relies on intensive data mining and data analytics, initiated by the CGST Mumbai Zone.” The agency also warned that it “will cover all the cryptocurrency exchanges falling in Mumbai zone and will also intensify this drive in the coming days.” The Binance-owned WazirX blamed a lack of clarity in regulation for the matter, saying it’s “been diligently paying tens of crores worth of GST every month.”

Also Read| Trending Stocks: NTPC, TATA, Wipro Maruti Suzuki and others in news today

Grayscale now holds $43 billion in crypto assets, down from $60.9 billion in early November

Grayscale Investments has $43.6 billion in crypto assets under management (AUM), the digital asset manager tweeted on Friday – a more than 28% decline from the $61 billion the digital asset manager held in early November. AUM in the Grayscale Bitcoin Trust, the firm’s largest holding, has decreased from $43.5 billion to $30.4 billion, a 30% decline during this time. The AUM of its second-biggest holding, the Grayscale Ethereum Trust, declined from almost $15 billion to $11.6 billion, a 22% drop. These decreases come as bitcoin and other crypto prices have fallen in recent weeks. But the total AUM also represents a roughly 170% increase over its $16.4 billion in holdings a year ago, reflecting a growing interest in cryptocurrency.