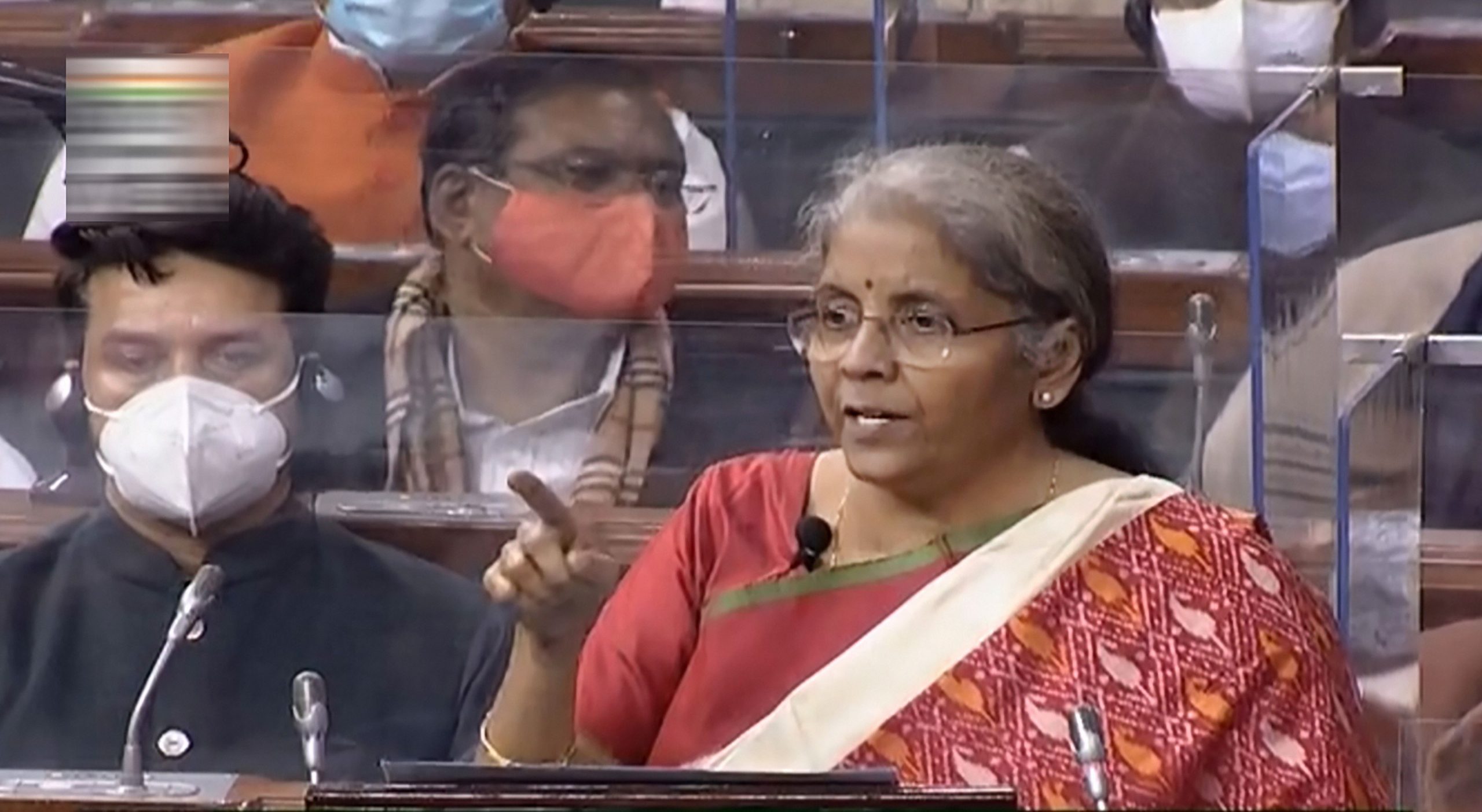

Finance Minister Nirmala Sitharaman, presenting her third Union Budget, announced an unprecedented package for the pandemic-hit health sector, a push for Atmanirbharta and infrastructure while leaving tax slabs unchanged.

To lift the coronavirus-ravaged economy, the minister unveiled a massive spending plan with the health sector getting a 137% hike in allocation. The planned expenditure of Rs 64,180 crore on health and well-being schemes was more than double the equivalent outlay in the previous budget, although it included Rs 35,000 crore for the country’s ambitious COVID-19 immunisation drive, with plans to vaccinate 300 million by July.

“This budget provides every opportunity for our economy to raise and capture the pace that it needs for sustainable growth,” Finance Minister Nirmala Sitharaman told parliament as she unveiled the annual budget.

Also read: ‘Bold and visionary’: Industrialists laud Union Budget 2021

Infrastructure was another focus area, with Rs 5.54 lakh crore allocation — 34.5 % more than in the previous budget — to be used for major projects, including roads and railways.

Later, at a press conference, Sitharaman said that these two sectors were identified for a big push to lift the economy.

Apart from these two sectors, the Budget mostly continued with earlier trends contrary to the Finance Minister’s promise that it would be a ‘never before’ Budget. In fact, it aligned with Prime Minister Narendra Modi who said on the eve of the Budget presentation — that it would be a continuation of a series of stimulus packages. “The Finance Minister had to present 4-5 mini budgets in 2020 in the form of different packages. So this Budget will be seen as a part of those 4-5 mini budgets, I believe this,” PM Modi had said.

Also read: Never before Budget: Investors, India Inc sigh in relief at absence of new levies, growth push

Divestments, including of national carrier Air India and part of the government’s stake in the country’s largest insurer, Life Insurance Corporation would help to raise Rs 1.75 lakh crores, Sitharaman said. But the sales of both state-run firms have been on the cards for some time, with the mooted IPO of the insurer sparking a walk-out by nearly 100,000 staff last year.

Social security benefits, including minimum wages, will be extended to workers in the gig economy, which has flourished amid cheap mobile data and abundant labour. The raft of spending measures will blow out the fiscal deficit to 9.5 % of GDP for the financial year ending March, Sitharaman said, from a forecast of 3.5 %.

In an impetus for small businesses, the Centre extended the tax holidays for startups by one year till March 31, 2022. To further boost the sector, the government has decided to “incentivise incorporation of one-person companies” and these companies will be allowed to grow “without any restriction on paid-up capital or turnover and to convert into any other type of company at any time.”

Also read: Budget 2021: No tax benefit for employer if delay in depositing employee PF

For senior citizens, the minister proposed that those above 75 years of age with only pension income will be exempted from filing tax returns. Banks paying the interest would deduct the tax on their behalf.

However, the budget did not have much to offer the common man as no changes in income tax slabs were announced by Sitharaman.