Indian Railway Catering and Tourism Corporation (IRCTC) Limited on September 27, 1999, was incorporated as a public Ltd., under the Companies Act 1956. As a Central Public Sector Enterprise completely owned by the government of India, it’s the only entity authorised by Indian Railways to supply catering services to railways, online railway tickets, and packaged water at railway stations and trains in India. The Indian government holds a 67.40% stake in IRCTC

Also Read: Now, track IRCTC live train status on WhatsApp

The IRCTC stock is set to undergo a stock split and here are the points you should know:

- The board of the Indian Railway Catering and Tourism Corporation (IRCTC) announced the splitting of the company’s one equity share into five i.e., 1:5

- A shareholder holding 10 shares, would be in possession of 50 IRCTC shares after the split

- Post-split the number of IRCTC shares will increase to 125,00,00,000 from 25,00,00,000

- IRCTC expects the stock split process to be completed within three months after receiving approval from the government of India

- The stock split is being done with the aim to boost liquidity in the capital market as the reduction of the market price and increase in liquidity make the shares affordable to retail buyers.

- IRCTC board also approved the unaudited financial results for the quarter which ended on 30 June 2021

- The company has reported a net profit of Rs 82.52 crore in the quarter ended June 2021 against a loss of Rs 24.6 crore

- Its revenue from operations rose 85.4 percent to Rs 243 crore

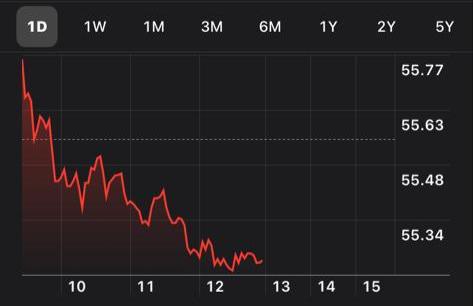

- On August 12, shares of IRCTC touched a 52-week high of Rs 2,727.95

- IRCTC made its market debut on October 14, 2019, and was listed at Rs 644 against its issue price of Rs 320 per share.