The Reserve Bank of India released its monetary policy report on

Friday, maintaining key lending rates such as the repo rate and reverse repo

rate at 4% and 3.35%, respectively.

So, what do the terms ‘repo rate’ and ‘reverse rate’ mean?

Also read: RBI Monetary Policy Committee projects CPI inflation at 5.7% for FY23

Repo Rate

Repo rate is the interest charged by the RBI when commercial banks

borrow from it by selling their securities to the central bank.

Essentially, it is the interest charged by the RBI when banks

borrow from it, similar to the interest charged by commercial banks when you

take out a vehicle or home loan.

Reverse Repo Rate

As the name implies, this is the interest rate that the RBI pays

commercial banks when they hold surplus cash reserves. The RBI uses this to

regulate the cash flow throughout the economy.

Through changes to the reverse repo rate, RBI can collect excess

cash in the economy by making it more attractive for commercial banks to store

cash reserves with the central bank.

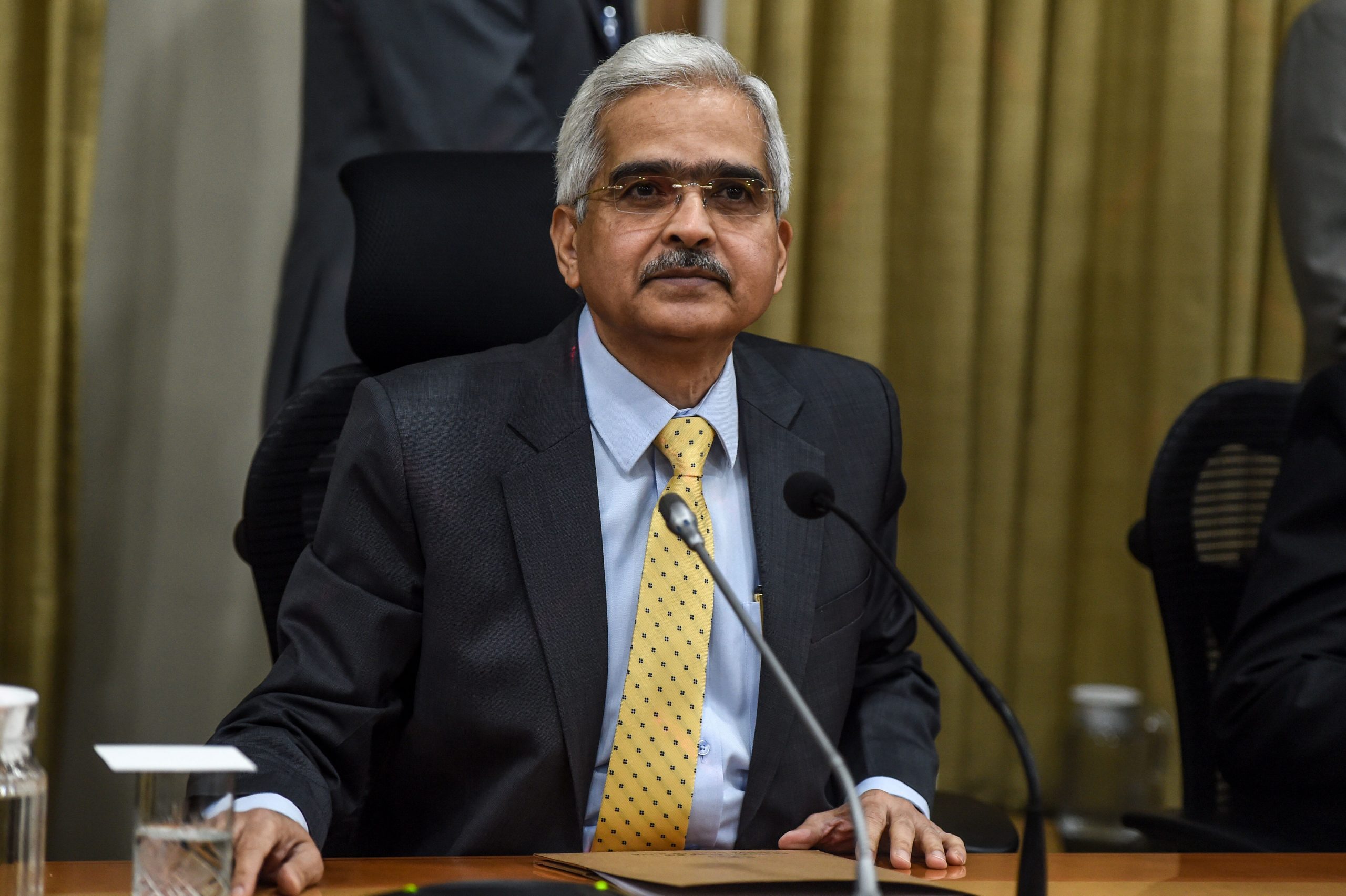

Also read: Situation in Europe can derail the global economy: Shaktikanta Das

Major Differences:

The repo rate is always higher than the reverse repo rate, as the

RBI needs to earn more than it pays.

Repo rate is used to control inflation and reverse repo rate is

used to control money supply.

Also read: Why RBI kept repo rate unchanged, governor Shaktikanta Das explains

A high repo rate helps drain excess liquidity from the market,

whereas a high reverse repo rate helps inject liquidity into the economy.

In short, a high repo rate will lead to less borrowing by

commercial banks. An increase in the reverse repo rate, on the other hand, will

result in commercial banks sending more funds to the RBI, increasing the money

supply.

Also read: RBI Monetary Policy Committee slashes India’s real GDP growth forecast to 7.2%

How does this affect you?

Repo and reverse repo rates are used by the RBI to gradually shift

interest rates through the banking industry and, as a result, the broader

economy.

If the RBI lowers the repo rate, it will allow your bank to lower

the interest rate on its loans, which will boost economic activity. This

encourages people to spend money because they believe cash in banks has less

value. Through loans, this also boosts consumer spending.

Also read: RBI monetary policy: 10-year bond yield surpasses 7% for the first time since 2019

If the RBI raises the reverse repo rate, commercial banks are

encouraged to store their reserves which in turn raises interest rates for

you. This forces people to save rather than spend, reducing the amount of

cash in circulation and, as a result, keeping inflation under control.