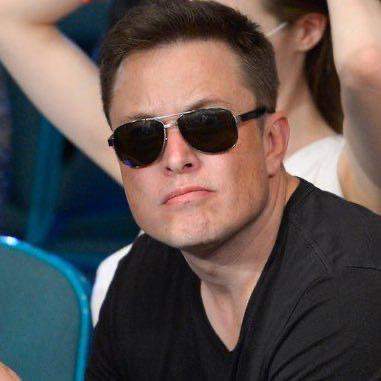

Twitter shareholders have launched a lawsuit against Elon Musk, accusing him of engaging in “unlawful conduct” in order to cast doubt on his attempt to buy the social media platform.

According to the lawsuit, which was filed late Wednesday in the United States District Court for the Northern District of California, the billionaire Tesla CEO attempted to drive down Twitter’s stock price in order to walk away from the transaction or negotiate a significantly cheaper purchase price.

Also read: Why Jack Dorsey resigned from the Twitter board

Twitter, based in San Francisco, is also named as a defendant in the case, which seeks class action status as well as monetary damages.

Musk’s representative did not immediately respond to a message seeking comment on Thursday. Twitter did not respond.

Musk offered to buy Twitter for $44 billion last month, but then stated that the sale cannot proceed until the firm produces details on how many accounts on the platform are spam or bots.

According to the lawsuit, Musk waived due diligence for his “take it or leave it” offer to buy Twitter. That means he gave up his right to inspect the company’s confidential financial records.

Furthermore, the issue of bots and false accounts on Twitter is not new. Last year, the business paid $809.5 million to resolve charges that it overstated its growth rate and monthly user counts. For years, Twitter has disclosed its bot estimates to the Securities and Exchange Commission, while simultaneously cautioning that its estimate may be too low.

Also read: SpaceX to raise $1.7 billion in new funding: Report

Musk has been selling Tesla stock to fund some of the acquisition, and shares in the electric carmaker have lost about a third of their value since the deal was announced on April 25.

The Twitter shareholders’ lawsuit says Musk has been disparaging Twitter in response to the company’s share price decline, violating both the non-disparagement and non-disclosure conditions in his contract.

According to the lawsuit, Musk “hoped to drive down Twitter’s stock price and then use that as a pretext to attempt to re-negotiate the buyout.”

Twitter’s stock closed Thursday at $39.54, 27 percent lower than Musk’s offer price of $54.20.

Prior to making his bid to buy Twitter, Musk revealed in early April that he had purchased a 9% stake in the firm. However, according to the lawsuit, Musk failed to declare the stake within the timeframe required by the Securities and Exchange Commission.

Also read: Tesla building ‘hardcore litigation’ team after sexual misconduct allegations against Musk

The lawsuit also claims that Musk’s final disclosure of the investment to the SEC was “false and misleading” since he used a form intended for “passive investors,” which Musk was not at the time because he had been given a spot on Twitter’s board and was interested in buying the company.

According to the lawsuit, Musk gained by more than $156 million from his failure to declare his growing shareholding on time, because Twitter’s stock price may have been higher had investors realised Musk was expanding his ownership.

“By delaying his disclosure of his stake in Twitter, Musk engaged in market manipulation and bought Twitter stock at an artificially low price,” according to the lawsuit.