The New York Times on Sunday published a major report into US President Donald Trump’s federal income tax affairs. For the report, the newspaper viewed tax data dating back 20 years, it said.

Here are the major revelations into Trump’s tax affairs, reported by the NYT:

No federal income tax

Trump paid no income tax in 11 out of the 18 years the newspaper examined. It was largely because he reported losing much more money than he made.

Paid $750 income tax bill

In 2017, i.e. a year after he became USA’s President, Trump’s federal income tax bill was just $750, the NYT reported. He paid taxes on a number of his overseas ventures, which includes $15,598 he or his companies paid in Panama, the $145,400 in India and the $156,824 in the Philippines.

Reduced tax bill via tax refund

The newspaper reported that Trump reduced his tax bill via a $72.9 million tax refund that is the subject of an Internal Revenue Service audit.

His golf courses lost money

“Most of Trump’s core enterprises — from his constellation of golf courses to his conservative-magnet hotel in Washington — report losing millions, if not tens of millions, of dollars year after year,” the report read.

Loans will soon be due for repayment

Hundreds of millions of dollars in loans he personally guaranteed will soon be due for repayment, the report noted.

Tax deductions

Trump took tax deductions on residences, aircraft and $70,000 in hairstyling for television, the NYT reported.

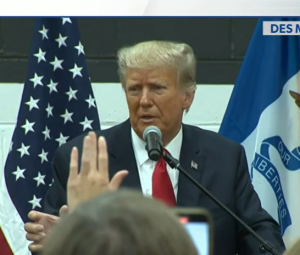

The report has been published a little over a month prior to the US presidential election, in which Trump is seeking re-election.

Immediately after the report got published on Sunday, the 77-year-old dismissed it as “totally fake news”.

The President and his Democratic rival Joe Biden are gearing up for the first presidential debate, slated to be held on Tuesday.