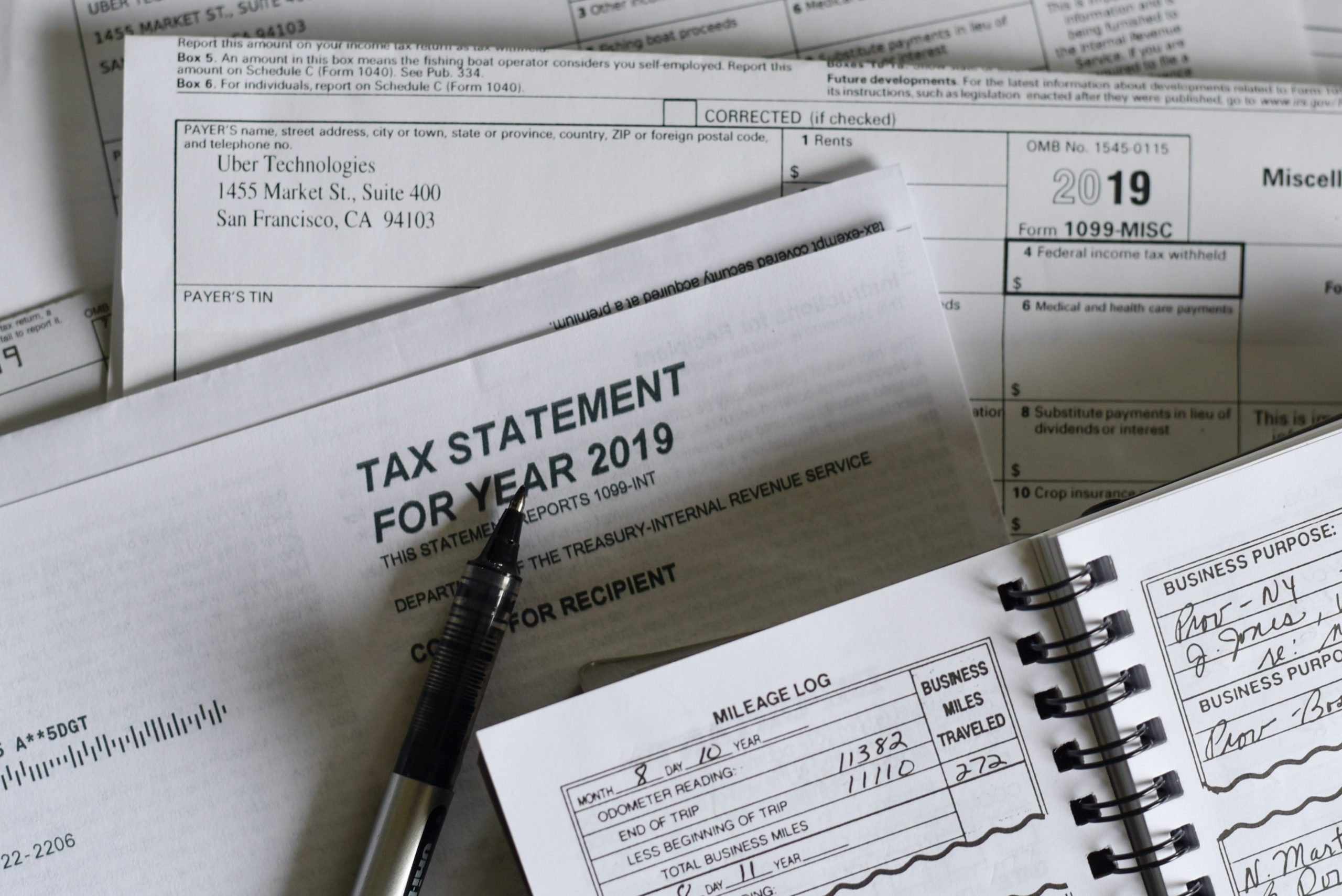

Filing%20Income%20Tax%20Return%20%28ITR%29%20informs%20the%20government%20of%20%26nbsp%3Bthe%20total%20income%20one%20has%20earned%20during%20a%20particular%20financial%20year%2C%20along%20with%20the%20taxes%20paid.%20As%20per%20income%20tax%20laws%2C%20ITR%20must%20be%20mandatorily%20filed%20if%20an%20individual%27s%20total%20income%20during%20the%20financial%20year%20exceeds%20the%20basic%20exemption%20limit.%20This%20exemption%20limit%20is%20set%20according%20to%20one%27s%20age%2C%20and%20for%20FY%202019-20%20is%20Rs%202%2C50%2C000%20for%20those%20below%20the%20age%20of%2060%20years.%26nbsp%3B

Some%20of%20the%20forms%20integral%20to%20this%20process%20are%20Form-16%20and%20Form%2026AS.%20While%20the%20first%20states%20the%20TDS%20%28Tax%20Deducted%20at%20Source%29%20from%20your%20salary%20and%20is%20provided%20to%20you%20by%20your%20employer%2C%20the%20latter%20is%20a%20consolidated%20tax%20statement%20with%20information%20for%20all%20taxes%20levied%20against%20your%20income%20and%20assets.

There%20are%20certain%20categories%20of%20people%2C%20however%2C%20which%20are%20compulsorily%20required%20to%20file%20ITRs%2C%20%26nbsp%3Birrespective%20of%20whether%20their%20income%20meets%20the%20threshold%20requirement.

Those%20include%2C%20non-residents%20who%20have%20income%20sourced%20in%20India%20above%20the%20specially%20set%20exemption%20limit%20%282.5%20lakh%20no%20matter%20what%20age%29%2C%20residents%20who%20hold%20foreign%20assets%20in%20another%20country%20and%20individuals%20whose%20income%20declared%20in%20Form%2026AS%20is%20higher%20than%20the%20exemption%20limit.%26nbsp%3B

Notably%2C%20some%20types%20of%20income%20are%20tax-exempt%20but%20are%20required%20to%20be%20reported%20while%20filing%20the%20Income%20Tax%20Return%20%28ITR%29.%20An%20example%20of%20this%20is%20the%20interest%20and%20amount%20received%20from%20one%27s%20Public%20Provident%20Fund%20%28PPF%29.%26nbsp%3B

Effective%20April%202020%2C%20taxpayers%20have%20been%20given%20the%20option%20to%20switch%20to%20a%20new%20tax%20regime%20which%20would%20involve%20forgoing%2070%20tax%20exemptions%20and%20deductions.%26nbsp%3B

%3Ca%20class%3D%22mention%22%20data-mention%3D%22%23Incometax%22%20data-user-id%3D%22WClcQ7qz7yj8%22%20href%3D%22/topic/income-tax%22%3E%23Incometax%3C/a%3E%20%3Ca%20class%3D%22mention%22%20data-mention%3D%22%23Taxpayers%22%20data-user-id%3D%225JyWiyrjVOEs%22%20href%3D%22/topic/tax-payers%22%3E%23Taxpayers%3C/a%3E%20%3Ca%20class%3D%22mention%22%20data-mention%3D%22%23IncomeTaxReturn%22%20data-user-id%3D%22LDpXWBrsoete%22%20href%3D%22/topic/income-tax-return%22%3E%23IncomeTaxReturn%3C/a%3E%26nbsp%3B%3Cbr%3E%3Cbr%3E%26nbsp%3B

%26nbsp%3B