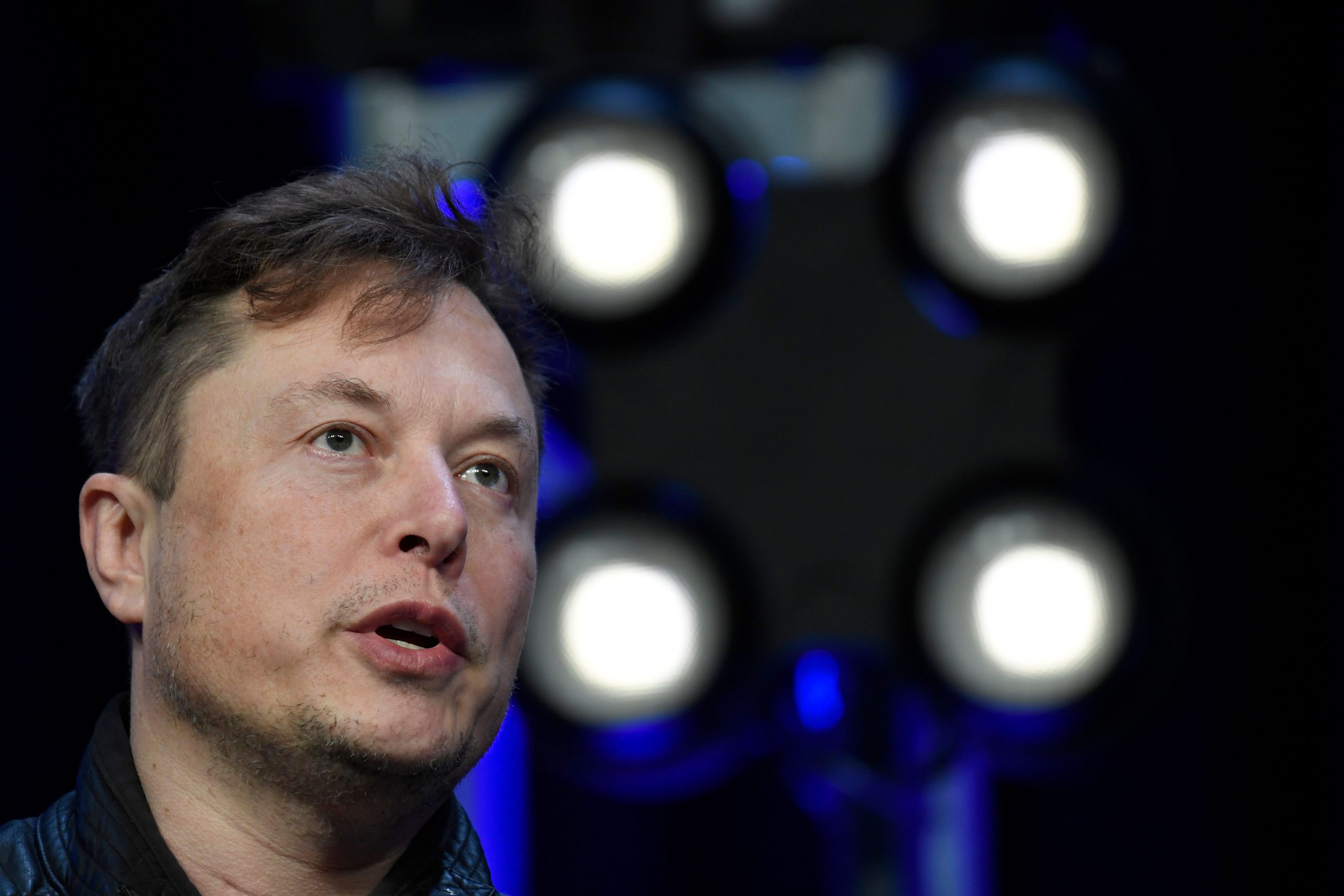

A group of nearly 24 investors, including Sequoia Capital, Andreessen Horowitz, crypto exchange Binance and asset management firm Fidelity has invested over $7.1 billion to back Elon Musk’s bid to take over microblogging site Twitter.

Binance founder Changpeng “CZ” Zhao referred to the commitment as “a small contribution to the cause”, reported Moneycontrol.

Investment firm Fidelity has committed $316 million for the deal. Saudi Arabian investor Prince Alwaleed bin Talal, who had initially opposed the takeover, also agreed to roll his $1.89 billion stake into the deal rather than cashing out, a filing showed.

Meanwhile, Oracle co-founder Larry Ellison, who is also an investor in Tesla, delivered the largest check, at $1 billion.

“Elon is the one person we know and perhaps the only person in the world who has the courage, brilliance, and skills to fix all of these and build the public square that we all hoped for and deserve,” tweeted Ben Horowitz, co-founder and general partner at Andreessen Horowitz.

“We invested, because we believe in Ev and Jack’s vision to connect the world and we believe in Elon’s brilliance to finally make it what it was meant to be. While Twitter has great promise as a public square, it suffers from a myriad of difficult issues ranging from bots to abuse to censorship. Being a public company solely reliant on an advertising business model exacerbates all of these,” added Horowitz.

Also Read: SpaceX, Tesla and now Twitter: The many businesses of Elon Musk

The CEO of Tesla will continue to hold talks with Twitter shareholders, including founder Jack Dorsey, to contribute shares to the proposed acquisition.

As a result of the fresh investment, Musk said the margin loan of $12.5 billion he had received from Morgan Stanley and other banks has been reduced to $6.25 billion. He also increased his total equity commitment to $27.25 billion.