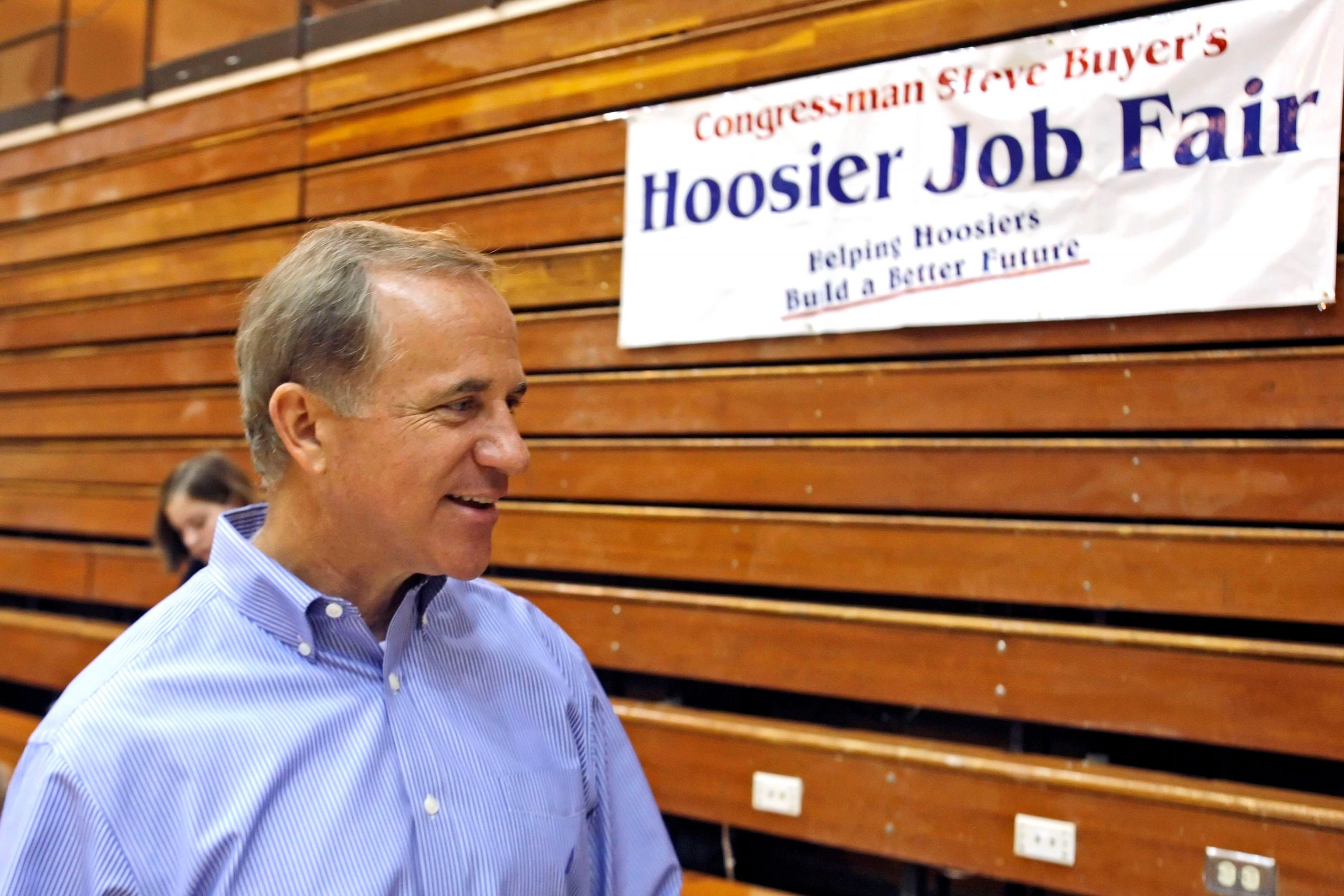

Former Indiana Republican Rep. Stephen Buyer has been charged with insider trading, the Securities and Exchange Commission announced Monday. As per the federal authority, the 63-year-old used accounts owned by his wife and longtime mistress to hide transactions.

Also read: WWE to revise finances to record Vince McMahon’s $14.6 million expenses

Along with the former congressman, nine others including technology company executives, a man training to be an FBI agent, and an investment banker were charged in four separate and unrelated insider trading schemes.

One indictment identified Stephen Buyer as someone who misappropriated secrets he learned as a consultant to make about $350,000 illegally. Buyer served on committees with oversight over the telecommunications industry, the indictment said.

Also read: Applying for a visa to the West? Reasons for delays and what Indians can do

Buyer, arrested Monday in Indiana, was accused in court papers of engaging in insider trading during a merger of T-Mobile and Sprint, among other deals. Documents said he leveraged his work as a consultant and lobbyist to make illegal profits.

U.S. Attorney Damian Williams told a news conference that the cases, in addition to several other recently announced crackdowns on insider trading, represent a follow through on his pledge to be “relentless in rooting out crime in our financial markets.”

Also read: Musk denies affair with Nicole Shanahan: Haven’t even had sex in ages

“We have zero tolerance, zero tolerance for cheating in our markets,” said Gurbir S. Grewal, director of the SEC Enforcement Division.

As per the complaint filed in the Manhattan federal court, Buyer, based on insider information, bought more than $1.5 million in stock in two separate companies, Sprint and Navigant Consulting.

Andrew Goldstein, the former congressman’s attorney, told CNBC, “Congressman Buyer is innocent. His stock trades were lawful. He looks forward to being quickly vindicated.”

“When insiders like Buyer — an attorney, a former prosecutor, and a retired Congressman — monetize their access to material, nonpublic information, as alleged in this case, they not only violate the federal securities laws, but also undermine public trust and confidence in the fairness of our markets,” Grewal said.