Amid the novel coronavirus taking a toll on people and reducing the job offers across the world, South Korea has become the first major Asian economy to raise interest rates since the pandemic began.

According to reports, the Bank of Korea increased its base rate of interest from a record low of 0.5 percent to 0.75 percent.

It is reportedly said that the move is aimed at helping curb the country’s household debt and home prices, which soared in recent months.

Also read: Will Americans get the $1,400 stimulus check in 2022?

Meanwhile, the central banks around the world are doing its best to balance the impact of COVID-19 pandemic against economic risks such as high inflation.

It is the first time the Bank of Korea has raised its main interest rate for almost three years. The decision comes as the central bank attempts to balance helping to support the country’s economic recovery against the risks of surging debt and rising inflation.

Earlier, the policy makers for Asia’s fourth largest economy had signalled that they were ready to increase the cost of borrowing since May.

However, due to the partial lockdown that took place last month has delayed the decision.

Also read: US visa delays worry international students

Central banks around the world are preparing to start dismantling their pandemic-era policies that have seen emergency stimulus measures brought in as economies were shut down to slow the spread of Covid-19.

Most countries that have raised the cost of borrowing so far this year have been in emerging economies that have seen inflation accelerate as demand for goods and services recovered.

Last week, in Asia, Sri Lanka became the first country in the region to raise interest rates.

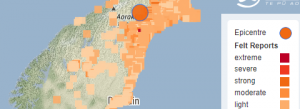

Also in the Asia-Pacific region, New Zealand was expected to become the first advanced economy to increase rates in the wake of the coronavirus crisis. But the day before the monetary policy decision was announced, Prime Minister Jacinda Ardern imposed a nationwide lockdown.

The Reserve Bank of New Zealand kept its rate at a record low of 0.25 percent, saying in a statement “the decision was made in the context of the Government’s imposition of Level 4 COVID-19 restrictions on activity across New Zealand”.