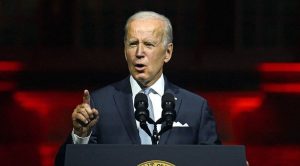

The administration of United States President Joe Biden rolled out a new move to curb corruption and illicit movement of funds in the country on Monday. The effort will be spearheaded by the Treasury Department.

The new plan aims to beef up state requirements of reporting real estate transactions that are carried out using cash in order to crack down on looking to launder their money through illegal means.

Also Read: US government imposes sanctions on crypto exchanges to curb ransomware

The Treasury Department– headed by Treasury Secretary Janet Yellen– was posting notice Monday seeking public comment for a potential regulation that would address what it says is a vulnerability in the real estate market, according to reports from Associated Press.

Currently, only title insurance companies in a dozen metropolitan areas across the country are required to alert authorities about all-cash transactions of residential properties, if the amount crosses the $300,000 mark.

United States Treasury Department’s director of Financial Crimes Enforcement Network, Himamauli Das said in a statement, “Increasing transparency in the real estate sector will curb the ability of corrupt officials and criminals to launder the proceeds of their ill-gotten gains through the US real estate market.”

The Treasury official added that the new strategy could “strengthen US national security and help protect the integrity of the US financial system”, according to reports from Associated Press.

Also Read: Federal bodies take steps to push voting rights after Biden’s executive order

The following metropolitan areas in the United States currently are bound by the plan: Las Vegas, San Diego, Chicago, New York City, Dallas-Fort Worth, Seattle, Los Angeles, San Francisco, Honolulu, San Antonio, Boston and Miami.

The United States real estate market has long been viewed as a stable way station for corrupt government officials around the globe and other illicit actors looking to launder proceeds from criminal activity, according to reports from Associated Press.

(With AP inputs)