Low-income families who signed up for the child tax credit before November 15 are likely to receive six months of payment next month. Eligible families will receive $300 for each child under the age of six and for those up to 17 will get $250 per child.

The Internal Revenue Service said that the families will receive all the money they are owed in the December 15 payout. This adds up to $1,800 per child under six and up to $1,500 per child over six.

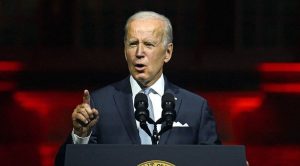

The tax credit was increased as part of President Joe Biden’s $1.9 trillion coronavirus relief package.

The credit was expanded to $3,600 annually for children under the age of six and $3,000 for children aged 6 to 17.

Eligible families were automatically enrolled, based on their 2020 tax returns. However, those who weren’t legally obligated to file returns because they don’t earn enough had to sign up to receive the payments.

Also read: Watch: Michael Strahan announces his Blue Origin space trip on live TV

“Nearly all families with kids qualify. Some income limitations apply. For example, only couples making less than $150,000 and single parents (also called Head of Household) making less than $112,500 will qualify for the additional 2021 Child Tax Credit amounts. Families with high incomes may receive a smaller credit or may not qualify for any credit at all,” the White House website reads.

Also read: Stocks wobble in morning trading, oil prices rise despite release of crude

“Returns are still being processed and we don’t have a final count right now. We want to emphasize that non-filer families that didn’t sign up by the deadline can still claim their full Child Tax Credit during next year’s tax season,” a Treasury spokesperson told Newsweek,