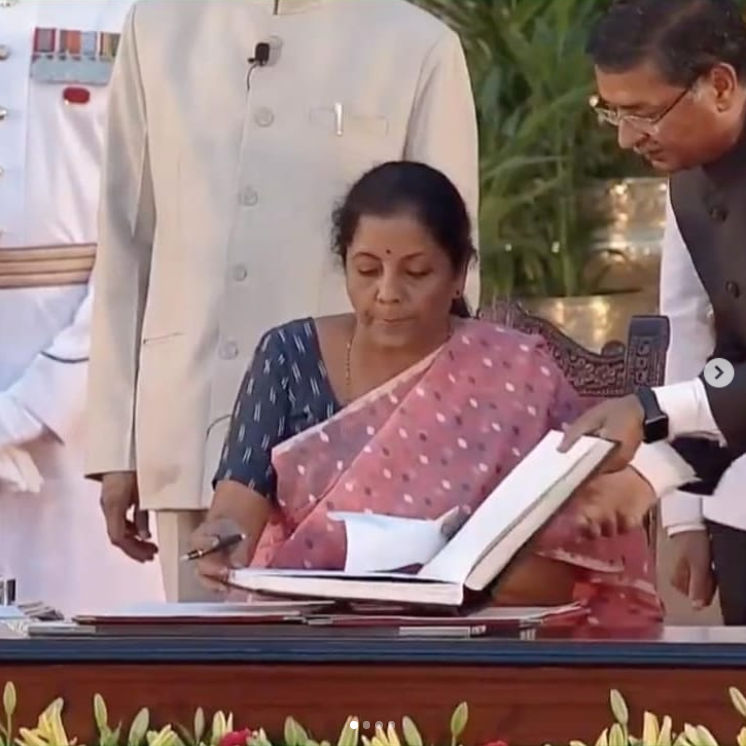

Union Finance Minister Nirmala Sitharaman met state finance ministers at Vigyan Bhawan today at 11 am for the customary pre-budget consultation meeting. This meeting is part of a series of discussions between Sitharaman and key stakeholders in preparation for Budget 2022-23.

Unlike past virtual meetings, this meeting of the finance ministers was held in person. According to a finance ministry press release, the Union finance minister has already met industry stakeholders, labour unions, financial sector players, agriculturists and renowned economists.

Also Read| Sensex drops 13 points while Nifty trades around 17,200 in early trade

Sitharaman began pre-budget talks with various stakeholder groups on December 15. This will be the fourth budget presented by Sitharaman for the National Democratic Alliance government in its second consecutive term.

The finance minister presents the Union Budget in Parliament every year on February 1 at 11 am. Previously, the Budget was presented on the last working day of February, and former finance minister Arun Jaitley modified that.

Also Read| S&P 500 records most new highs while Dow Jones surged 90 points

The Budget, often known as the annual financial statement, is an account of the government’s estimated receipts and expenditures for the fiscal year, pursuant to Article 112 of the Constitution. The Budget covers the fiscal year, which runs from April 1 to March 31.

The Budget is broken into two parts: the revenue budget and the capital budget. The revenue budget comprises revenue receipts and expenditures. There are two kinds of revenue receipts: tax revenue and non-tax revenue. Revenue expenditure is incurred in the day-to-day operation of the government and in the provision of different services to people.

Also Read| Trending Stocks: Bajaj, NTPC, KPI, IRB and others in news today

The capital budget includes the government’s capital receipts and payments, such as loans from the public, foreign governments, and the RBI. Loans account for a large portion of the government’s capital receipts. Capital expenditure is defined as spending on the development of machinery, equipment, buildings, health care facilities, education, etc.