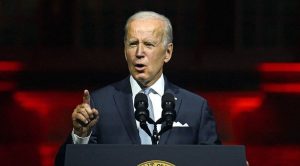

Wall Street stocks fell during the morning trade on

Thursday and oil prices also slipped President Joe Biden prepares to order the

release of 1 million barrels per day from the nation’s strategic petroleum

reserve.

The move to raise oil supply in the market is part of an

attempt to control energy prices, which are as high as 40% this year.

Also Read | How much does a Blue Origin spaceflight ticket cost?

The S&P 500 slipped 0.4% as to 10:18 am Eastern Time

Zone. The Dow Jones Industrial Average fell 218 points or 0.6% to 35,010 and

the Nasdaq fell 0.3%.

Technology and Communications stocks were among the

biggest gainers in the market. Several companies have heavy stocks have pricey

stock values that tend to push the broader market in either direction. Apple

slipped 1% and Netflix slipped 1.5%.

Also Read | US Premarket: Walgreens, Dell and other stocks making biggest moves

Bond yields declined. The yield on the 10-year Treasury

fell to 2.3% from 2.36% late Wednesday.

US crude oil prices declined by 3.8%. Brent, the

international benchmark, fell 3.2%.

A slight pullback in oil prices has helped to moderate

soaring prices amid Russia’s invasion of Ukraine. The conflict has raised

concerns that supply shortages will only worsen continuously rising inflation

that threatens businesses and consumers globally.

Also Read | Crude oil prices fall as Joe Biden considers releasing massive oil reserves

An inflation measure from the Commerce Department surged

6.4% in February, compared with a year ago, marking the largest year-on-year

rise in four decades.

Energy prices have been a primary factor in pushing

inflation higher and Biden’s plan to release more oil into the market comes as

some relief is expected from the oil body OPEC.

Also Read | Ukraines’ economy to shrink by 20%, Russias’ by 10% in 2022: Report

OPEN and its allied oil-producing countries including

Russia are sticking to a moderate rise in the amount of oil they supply to the

world, a move that supports higher prices.

The benchmark S&P is on its way to closing out the

month of March with a 4.8% gain after losses in January and February. The index

is moving towards a first-quarter loss of 3.8%, marking its first quarterly

loss since the first quarter of 2020, when the pandemic stunned global markets

and the economy.

Investors received a modest update on the job market on

Thursday. More Americans applied for unemployment benefits last week, but

layoffs remain at historic lows. Investors will get a complete report on Friday

when the Labor Department will release employment data for March.