The reverse repo rate is the rate at which India’s central bank, the Reserve Bank of India, borrows from banks to take or release cash from and into the system.

It is a tool the The Reserve Bank of India (RBI) uses when it feels there is too much money floating in the banking system. Higher reverse repo rate means that the banks will get a higher rate of interest from RBI. As a result, banks prefer to lend their money to RBI instead of lending it to others.

A lower reverse repo implies that banks would be encouraged to lend to other borrowers to earn more rather than park its funds with the RBI.

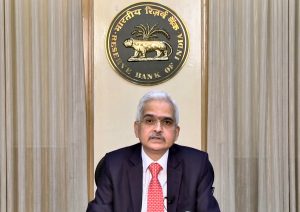

The current reverse repo rate stands at 3.35%, fixed by the RBI in order to boost the economy by increasing the flow of money. RBI governor Shaktikanta Das unveiled these measures to maintain liquidity in the system easing the economic financial stress caused in the country by the coronavirus pandemic.

Reserve Bank of India (RBI) administers and monitors monetary policies to control liquidity, credit availability, inflation and economic growth of the country. These monetary policies help RBI in promoting investments and increasing diversification in financial markets along with improving the market’s efficiency.

Repo and Reverse Repo Rate are such tools of the central bank of India’s monetary policy to help regulate the supply of money in the economy.