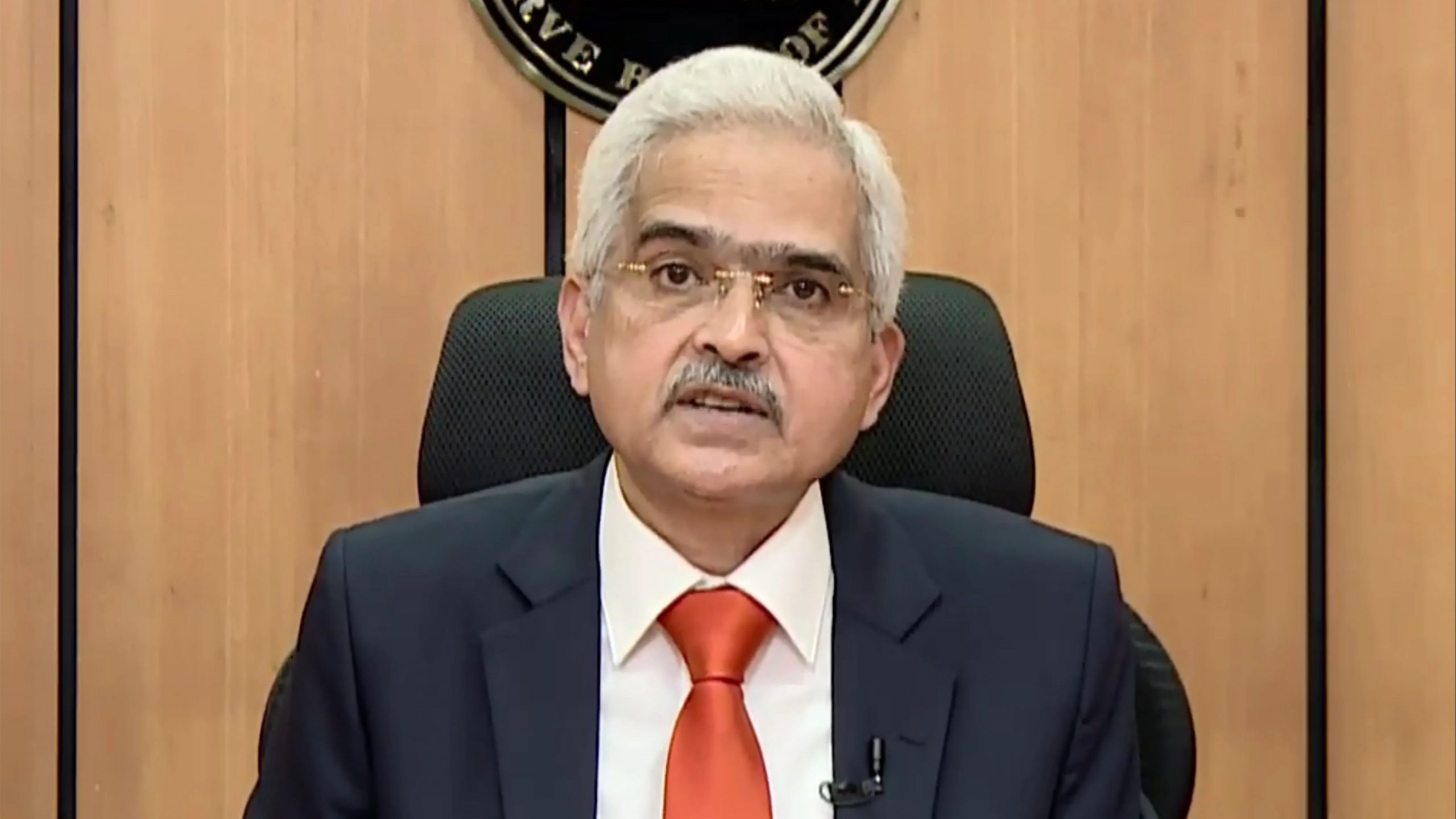

The Reserve Bank of India, while expressing concern over the uncertainity caused by the surge in COVID-19 cases, left key lending rates unchanged and retained the projection of real GDP growth for 2021-22 at 10.5%. The announcement of the new financial year’s monetary policy on Wednesday is likely to translate into home and auto loan EMIs remaining as they were.

“The projection for CPI inflation has been revised to 5% in Q4 of 2021, 5.2%, in Q1 of 2021-22, 5.2% also in Q2 of 2021-22, 4.4% in Q3, and 5.1% in Q4 with risks broadly balanced,” Das said, quotes news agency ANI.

The RBI governor added, “On March 31, 2021, the government retained the inflation target at 4% with the lower and upper tolerance levels of 2% and 6%, respectively, for the next five years that is from April 2021 to March 2026.”

The RBI Governor’s statement and press conference comes after a three-day review meeting starting Monday of the Monetary Policy Committee (MPC), which comprises six members.

Das said the MPC kept its estimate for India’s economic growth unchanged at 10.5% for the current fiscal year.