Tesla Inc shed $126 billion in value on Tuesday as investors feared that CEO Elon Musk would have to sell the shares to pay his $21 billion equity commitment to Twitter Inc’s $44 billion takeover.

Also Read| Does Elon Musk’s Twitter need a board? Experts weigh in

Despite the fact that Tesla is not engaged in the Twitter deal, its stock has been targeted by speculators after Musk refused to reveal publicly where the money for the acquisition came from. The 12.2% decrease in Tesla’s stock on Tuesday equalled a $21 billion drop in the value of his Tesla holding, which is the same as the $21 billion he put into the Twitter purchase.

Also Read| Twitter will have to adapt: European Union on Elon Musk’s takeover

Concerns over Musk’s forthcoming stock sales, as well as the prospect that he is getting distracted by Twitter, impacted Tesla shares, according to Wedbush Securities analyst Daniel Ives. He added, “This is producing a bear festival on the name.”

Also Read| Elon Musk Twitter deal: Who’s in, who’s out since change of ownership

Tesla’s shares plummeted amid a difficult backdrop for many technology-related equities. On Tuesday, the Nasdaq fell to its lowest level since December 2020, as investors feared a weakening global economy and more aggressive rate rises from the US Federal Reserve.

Also Read| US Stock Market: DJIA, S&P500, Nasdaq and Russell ended 2.5% down on Tuesday

Even though Musk agreed to acquire Twitter for $54.20 per share in cash on Monday, Twitter’s stock fell 3.9% to settle at $49.68 on Tuesday. The increasing difference underscores market anxiety that the sharp drop in Tesla’s stock, which accounts for the majority of Musk’s $239 billion fortune, may cause the world’s richest person to reconsider the Twitter acquisition.

Also Read| Elon Musk explains his meaning of ‘free speech’ after Twitter takeover deal

“If Tesla’s share price continues to remain in freefall that will jeopardize his financing,” said OANDA senior market analyst Ed Moya.

Also Read| Elon Musk’s Twitter takeover means early Christmas for Morgan Stanley

Musk also took out a $12.5 billion margin debt linked to his Tesla equity as part of the Tesla acquisition. He’d previously taken out a loan against nearly half of his Tesla stock.

Also Read| Tucker Carlson, Mark Levin make Twitter comeback after Elon Musk’s takeover

Investors became concerned about a “cascade of margin calls” on Musk’s loans, according to University of Maryland professor David Kirsch, whose research focuses on innovation and entrepreneurship.

Also Read| Why Elon Musk buying Twitter changes the internet

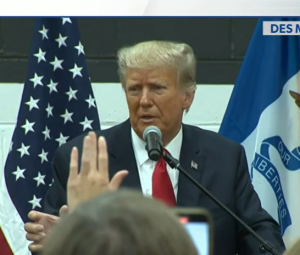

Separately, shares of Digital World Acquisition Corp (DWAC) surged over 14% to $40.80 on Tuesday after Twitter announced accepting the private deal with Elon Musk. DWAC is the Special Purpose Acquisition Vehicle (SPAC) poised to take former President Donald Trump’s Trump Media and Technology Group (TMTG) public to the stock exchange.

Also Read| What is Excession, the family office handling Elon Musk’s Twitter takeover?

The DWAC stock had declined 12.9% on Monday, bringing its year-to-date losses to over 30%. The special purpose acquisition company will soon merge with the Trump Media and Technology Group.

Also Read| Elon Musk’s ‘free speech’ Twitter may run into trouble with Indian laws

The media company includes a social media platform called Truth Social. In January 2021, when Trump was banned from Twitter and Facebook, it raised the potential market share for his Truth Social App. Trump’s platform is being seen as an alternative to social media giants Twitter and Facebook. With Trump having a huge following on Twitter and a huge fan and voter base, Truth Social was set for a solid launch. But the new platform has had a very unlikely start due to technical glitches and the departure of key executives.

Also Read| A look at Twitter’s history with free speech amid Elon Musk’s takeover

However, now it seems that Musk sees Twitter as a more open platform and is less likely to ban people from it. This definitely makes it more of a threat to Truth Social and DWAC stock.