Gold prices declined on Tuesday as US Treasury yields rose to multi-year highs in response to Federal Reserve Chair Jerome Powell’s strong inflation stance, but safe-haven bullion was supported by an escalation in the Ukraine conflict.

The spot price of gold was $1,931.84 per ounce, down 0.2%. Gold futures in the United States remained unchanged at $1,930.20 per ounce.

Also Read| LPG price hike: After fuel, domestic cylinders price increased by Rs 50

Powell hinted that the Federal Reserve will raise interest rates more aggressively than usual if required to combat “much too high” inflation.

The yield on the benchmark 10-year Treasury note soared over 2.3% for the first time since May 2019, as the highest observed spread between rates on two-year and 10-year Treasury notes narrowed further, perhaps signalling an impending economic slowdown.

Also Read| Petrol, diesel price hiked after 4 months, LPG price increased by Rs 50

Sharp changes in the US Treasury market are increasingly pointing to the likelihood of a recession, with markets questioning the Fed’s strategy to ensure a “soft landing” for the economy as it hikes interest rates to combat inflation, according to market analysts.

Higher yields and interest rates raise the potential cost of owning non-interest-paying gold.

Also Read| US Stock Market: DJIA, S&P500, Nasdaq and Russell ended in red on Monday

Slowing gold’s decline, Ukraine stated on Monday it will not accept Russian ultimatums after Moscow demanded it stops defending besieged Mariupol, escalating the conflict.

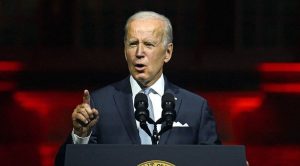

When European Union leaders meet this week with US President Joe Biden for a series of talks, they will decide whether to impose an oil embargo on Russia in response to its invasion of Ukraine.

Also Read| Trending Stocks: REC, Avantel, CyberMedia, NHPC, KEC and others in news today

Palladium, which is used in catalytic converters by automakers to reduce pollution, lost 0.5% to $2,571.64 per ounce. Fears of supply interruptions from main supplier Russia drove the auto-catalyst metal to a record high of $3,440.76 on March 7. Spot silver is down 0.2% to $25.15 per ounce, while platinum fell 0.3% to $1,033.99.