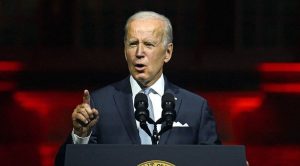

A larger-than-expected spike in inflation is the latest headache for US President Joe Biden and his bid to use massive government spending to both revitalise and reshape the world’s largest economy.

The Labor Department on Wednesday reported consumer prices were 4.2% higher last month than in April 2020, their biggest year-on-year increase since 2008 as the United States bounced back from the COVID-19 pandemic.

Washington policymakers had expected inflation to surge as the economy reopens following last year’s business restrictions to stop the virus, and the White House Council of Economic Advisers cast the spike as a predictable part of the recovery.

“Some of April’s price increase… reflects pandemic-induced supply chain pressures that are expected to be transitory,” the council said on Twitter.

“Separately, part of the increase was due to a ‘normalisation’ in prices in some sectors that had been hard hit by the pandemic, as their prices continue to climb out of their pandemic low level.”

But analysts agreed the April jump was much higher than forecast, and spared worries that the United States could see a sustained price spiral.

“This report does mean that the first part of the higher inflation story — the reopening spike — is real,” Ian Shepherdson of Pantheon Macroeconomics said.

“It’s no longer a forecast, and further hefty increases are coming,” though they may only last for a few months, he said.

Also Read: US unemployment claims fall by 92,000 as job crunch eases

The United States hasn’t seen sustained inflation for decades, but economists have for months predicted prices would jump after COVID-19 vaccines allow for the loosening of the pandemic’s unprecedented business restrictions.

Complicating the picture was Washington’s moves to support consumers and businesses over the past year by passing three costly rescue plans that, among other provisions, gave many Americans stimulus checks totaling hundreds of dollars per-person.

Biden’s $1.9 trillion American Rescue Plan passed in March was the latest of these bills, but the Democratic president has proposed two other measures costing around $4 trillion and targeted at revitalising infrastructure and the US workforce.

The Republican opposition has condemned these proposals as wasteful, and Congressman Mike Waltz on Wednesday seized on the inflation numbers to accuse the Biden administration of wanting “to spend our way into a spiral of debt while our economy attempts to reopen.”

Also Read: Disappointing April jobs data pose new challenge for Joe Biden’s agenda

The April consumer price index data (CPI) from the Labor Department contains evidence that the inflation is indeed temporary, but also hitting historic levels in parts of the economy.

A third of the month-on-month CPI increase was due to a 10% jump in prices of used cars and trucks, its biggest rise since the Labor Department began tracking it in 1953, according to the report.

Airfares shot up 9.6% from a year ago as travelers, spurred by declining COVID-19 case counts brought on by vaccinations, booked flights.

Food prices rose 0.4% from March, including both groceries and takeaway meals, far above the 0.1% growth registered the month before.

CPI was up 0.8% overall from March, seasonally adjusted, while “core” CPI, excluding volatile food and energy prices, was up 0.9% from a month ago, its biggest monthly jump since 1982. Compared to April 2020, the latter had risen 3%.

The report also poses a challenge to the Federal Reserve, which has pledged to keep lending rates at their current zero level for years to help the economy achieve full employment — a plan that sustained high inflation could scupper.

Fed Vice Chair Richard Clarida said he was “surprised” by the April price spike but during a conference of the National Association for Business Economics said the central bank has been “saying for some time that reopening the economy would put some upward pressure on the price level.”

In an analysis of the data, Kathy Bostjancic of Oxford Economics said, “In the coming months, ongoing base effects, price increases stemming from the reopening of the economy and some pass-through of higher prices from supply chain bottlenecks should prompt higher inflation.”

“However, we believe part of the acceleration in inflation will be transitory, and we share the Fed’s view that this isn’t the start of an upward inflationary spiral,” she said, predicting the price increases would cool next year.