US President Joe Biden‘s administration on Thursday announced it will automatically erase student loan debt for more than 300,000 Americans with severe disabilities — amounting to over $5.8 billion in debt — citing their inability to earn sufficient income.

“We’ve heard loud and clear from borrowers with disabilities and advocates about the need for this change and we are excited to follow through on it,” Education Secretary Miguel Cardona said in a statement, according to the Associated Press.

ALSO READ | When do the students’ loans resume?

The move marks the start of a broader overhaul of a program that has been criticised for having overly burdensome rules.

Although the federal government offers student debt relief for people who are “totally and permanently disabled” and have limited incomes, the current rules require them to submit documentation of their disability and undergo a three-year monitoring period to prove they’ve low income.

Critics opine that owing to the complex and rigid rules, tens of thousands of people have been dropped from the program and had their loans reinstated simply because they failed to submit proof of their earnings.

For years, activists and supporters have urged the Education Department to abolish the monitoring period altogether and offer automatic debt relief to those who have previously been determined to be permanently handicapped by the Social Security Administration.

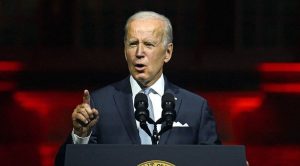

ALSO READ | Joe Biden administration extends student loan payment pause till January 31

Both requests will be satisfied under the new action. Starting in September, the Education Department will begin erasing student debt for 323,000 Americans who have been identified as permanently handicapped by Social Security records.

Borrowers will be contacted after their relief request has been granted. By the end of the year, all of the debts are expected to be discharged.

The agency also intends to discontinue the three-year monitoring period that was put in place during the epidemic. According to the agency, the change will be solidified via a federal rulemaking process that will begin in October.