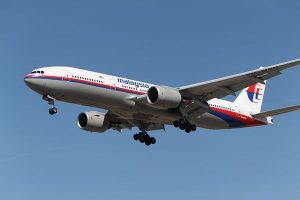

Tata Sons will retake Air India (AI) from the Central government after making a winning bid of Rs 18,000 crore for a 100% stake in debt-laden state-run carrier. AI was started by the Tata Group in 1932, but was nationalised after the government completed its stake in the the airline in 1953.

Tata Sons wins bid to acquire national carrier Air India

Implications of the deal for government

Prime Minister Narendra Modi is likely to present the deal as his government’s commitment to reducing its role in the economy and saving taxpayers from paying for daily losses of AI.

AI couldn’t trim its losses despite being merged with the domestic carrier, Indian Airlines, by 2007.

In fact, since 2009-10, the government (and indirectly the taxpayer) has spent over Rs 1.1 lakh crore to either directly make up the losses or raise loans to do so, reports The Indian Express. As of August 2021, AI’s debt was Rs 61,562 crore. AI’s operations cost the government a daily loss of Rs 20 crore, or Rs 7,300 crore per year.

Tata Sons acquires Air India: How history repeats itself

Still, the deal will not significantly help the government achieve its disinvestment target of the current year. The Tatas will take care of Rs 15,300 crore of the total AI debt of Rs 61,562 crore and will pay an additional Rs 2,700 crore in cash to the government. That leaves Rs 43,562 crore of debt. The assets left with the government, such as buildings, etc., will likely generate Rs 14,718 crore. But that will still leave the government with a debt of Rs 28,844 crore to pay back.

Air India’s homecoming: A journey of Tata’s love for aviation

What the acquisition means for Tatas

The stake sale comprises Air India’s whole ownership of AI Express Ltd and a 50% stake in Air India SATS Airport Services Private Ltd. When combined with AIXL, the debt-laden carrier controls 50.64% of the International market share among Indian carriers, Money Control reported.

Tata group will also get the second-largest fleet in the country of 144 aircraft. Currently, Air India serves 42 international destinations. Tata Group already holds around 84% of AirAsia India and 51% of Vistara.

The return of Maharaja: Story behind Tata’s Air India’s regal mascot

As per a Money Control report, Tata Sons would gain ownership of 4,400 domestic and 1,800 international landing and parking slots at domestic airports, as well as 900 slots at foreign airports, as a result of the airline’s divestment.

Air India operated 2712 departures in November 2019 and is presently the second-largest participant at Delhi – the country’s busiest airport in terms of air traffic and departures.