Repo Rate, or also known as repurchase rate, is the interest rate at which the Reserve Bank of India lends money to commercial banks when they have a scarcity of funds.

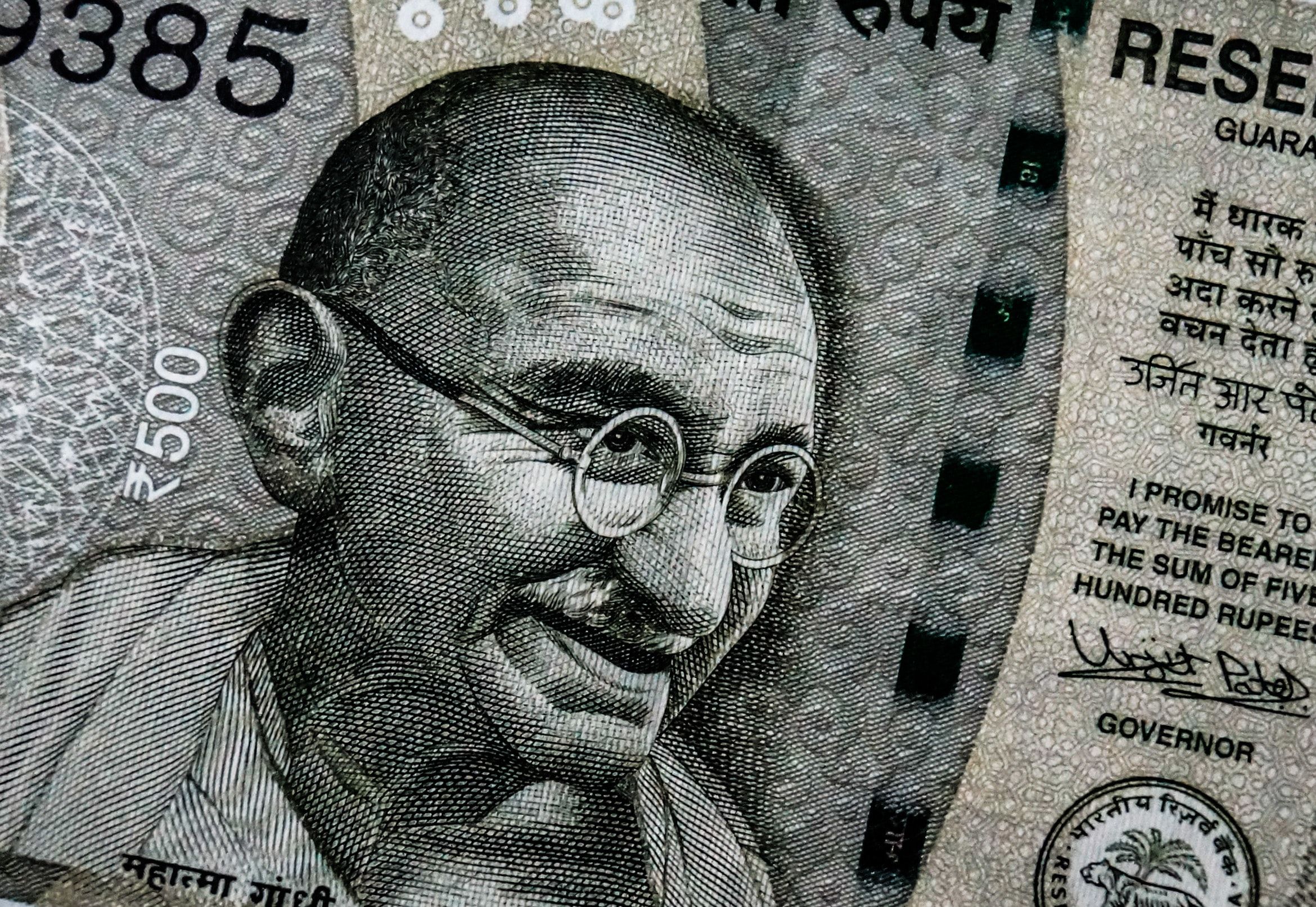

It is one of the tools of the central bank to regulate the flow of money in the economy. The Reserve Bank of India (RBI) administers and monitors monetary policies to control liquidity, credit availability, inflation and economic growth of the country. These monetary policies help RBI in promoting investments and increasing diversification in financial markets along with improving the market’s efficiency.

When India announced a nationwide lockdown on March 25 in its efforts to stop the spread of the deadly coronavirus, most economic activities came to an abrupt halt. This was followed by the RBI slashing the repo rate by 75 points to encourage commercial banks to borrow more money, thus, increasing the flow of money in the economy.

A lower repo rate reduces banks’ borrowing costs, allowing them to cut interest rates for home, auto and corporate loan borrowers. The current repo rate stands at 4%, down from 5.15 %.

Sometimes, to decrease the money in supply, the RBI increases repo rate, thus, discouraging banks to borrow funds.