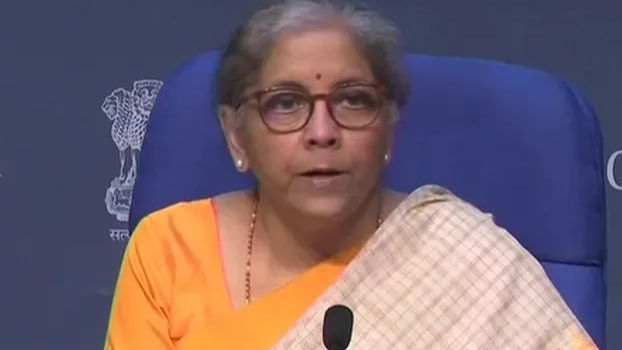

Union Finance Minister Niramala Sitharaman soaked under the spotlight on February 1, 2020 to a propose a Union Budget that was not totally aware of the COVID-19 pandemic that was waiting for the country. However, the India’s GDP growth rate dipping to a decade low, the budget was centred around three ideas — Aspirational India, Economic development, A Caring Society.

Along with the announcements of the New Education Policy hinted then with a Rs 99,300 crore allocated to the sector, the government proposed Rs 3000 crore fir ‘Skill India’.

Moreover, the second budget of the BJP-led NDA saw a fight against Tuberculosis be mentioned more than a few times. Sitharaman also proposed new income tax slabs and lower rates.

Here are certain highlights of budget 2020-21 (sector wise):

Senior citizens and minorities

Rs 9,000 crore allocated for the welfare of senior citizens, Rs 53,700 crore for Schedule Tribes and Rs 85,000 crore for the welfare of Scheduled castes and Other Backward Classes.

Railways

The budget allocated for the railways was a whopping Rs 70,000 crore with an outlay for capital expenditure amounting to Rs 1.61 lakh crore. A proposal for setting up of a large solar power capacity alongside the rail tracks on land owned by the railways was made. The budget further stated that redevelopment of four stations and operation of 150 passenger trains would be done through the public-private-partnership (PPP) mode. It announced introduction of more Tejas type trains which will connect iconic tourist destinations.

Agriculture:

The budget allocation for agriculture and allied activities amounted upto Rs 2.83 lakh crore. It promised doubling farmers incomes by 2022. Furthermore, the agri-credit availability was set at Rs 15 lakh crore for 2020-21. In the comprehensive measures for 100 water stressed districts, the government decided to provide 20 lakh farmers to set up standalone solar pumps and help another 15 lakh farmers to solarise their power grid. The Village storage scheme proposed to be run by women SHGs. It also suggested that the Indian Railways should have refrigerated coaches capability in ‘kisan trains’ to carry perishables and milk. Krishi UDAN on international and national routes also grabbed headlines.

Health and Sanitation:

An allocation of Rs 69,000 crore was made for the health sector and Rs 12,300 crore for Swachh Bharat in 2020-21. A proposal was made to set up hospitals in Tier-II and Tier-III cities with the private sector using PPP. Expansion of Jan Aushadhi scheme to provide for all hospitals under Ayushman Bharat was set to be done by 2025.

Education:

A Rs 99,300 crore allocation was set aside for the education sector in 2021 and about Rs 3,000 crore for skill development. Urban local bodies were to provide internship to young engineers for a year. Degree-level full fledged online education programmes by institutions ranked in top 100 in NIRF rankings, especially to benefit underprivileged students, were proposed. A national police university and a national forensic science university was proposed to be setup. IND SAT exam for students of Asia and Africa would promote “study in India” programme, the budget said.

Infrastructure:

Budget 2020-21 proposed to provide Ra 1.7 lakh crore for transport infrastructure. A Chennai-Bengaluru Expressway was to be started. The budget aimed at achieving electrification of 27,000 km of lines. A plann to have a large solar power capacity for Indian Railways was put in place. The government also proposed a Bengaluru suburban rail project at a cost of Rs 18,600 crore. Government decided to monetise 12 lots of national highways by 2024 and 100 more airports were planned to be developed by 2024 to support UDAN.

Income tax

Considerable changes were made in the income tax slabs. Imvome between Rs 5 lakh and Rs 7.5 lakh saw tax reduce to 10% from 20%. Income range between Rs 7.5 lakh to Rs 10 lakh saw tax reduced to 15% from 20%. Income falling between Rs 10 lakh to Rs 12.5 lakh saw tax reduced to 20% from 30%. For income between Rs 12.5 lakh to Rs 15 lakh tax was reduced to 25% from 30%. For those who have an income above Rs 15 lakh were asked to continue at 30%, but without exemptions. Over 70 deductions were removed. Companies were asked to no longer pay Dividend Distribution Tax (DDT). However, Aadhaar-based verification for GST compliance was introduced.