Jared Kushner’s family firm Kushner Cos has filed papers to raise at least $100 million by selling bonds in Israel, Wall Street Journal reported on Tuesday.

It would be the company’s first raise of capital in the Israeli bond market.

Kushner Cos. filed the papers this month with the Israel Securities Authority and would sell the bonds on the Tel Aviv Stock Exchange. The company has raised other forms of capital in Israel in the past from both banks and equity partners.

“Kushner is considering the option of issuing bonds on the Tel Aviv Stock Exchange. The company has had years of success working with Israeli institutions as both a borrower and a partner,” WSJ quoted a company spokesperson.

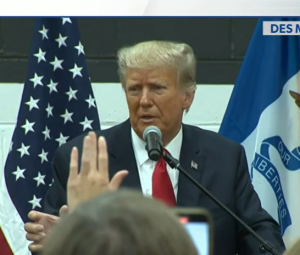

The move by Kushner Cos. is likely to attract criticism of the potential conflicts of interest between Jared Kushner’s role in the White House and his family’s business. Kushner, who is President Trump’s son-in-law as well as a White House advisor, has played a lead role in advancing the Trump administration’s Middle East agenda.

When he joined the Trump administration, Kushner sold personal stake in the family business to his family members to avoid any conflict of interest issues but his critics think that is not enough.

According to the WSJ report, the company has raised other forms of capital in Israel in the past including loans from Bank Leumi and Bank Hapoalim, as well as equity investments from companies like Psagot Investment House and Harel Insurance Investments and Financial Services Limited.

Kushner was last week felicitated by Israeli Prime Minister Benjamin Netanyahu for his “contributions” in forging the recently conclulded Arab peace deal.

Under the deal, Israel normalised relations with three arab nations — Morocco, UAE, and Bahrain. Kushner was appointed by Trump to see through the deal in the region.