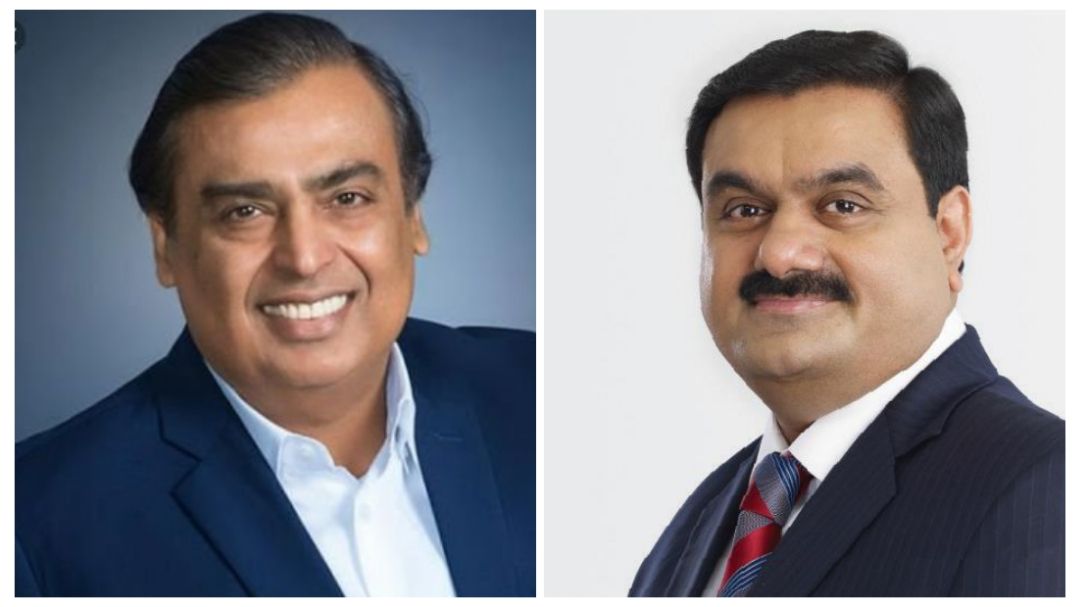

Adani Group chairman Gautam Adani surpassed Reliance Industries Limited (RIL) chairman Mukesh Ambani’s net worth on Wednesday to become Asia’s richest person for the first time. The gap between the wealth of the two super-billionaires had been narrowing down since the dramatic turnaround in Adani’s fortunes beginning March 2020, when his wealth stood at around $4.91 billion. Within the last 20 months, Adani’s net worth has increased by a staggering 1808% compared to the 250% growth in Ambani’s wealth.

Tech tycoons Azim Premji and Shiv Nadar are trailing behind with estimated net worth of $37.1 billion and $28 billion, respectively.

Here’s how much Elon Musk lost in a week after Tesla stock sale poll

DMart founder Radhakishan S Damani is India’s fifth richest person with an estimated net worth of $25 billion.

According to Bloomberg Billionaire Index, Adani’s wealth stood at $88.8 billion on November 23 compared to Ambani’s net worth of $91 billion. However, on November 24, shares of RIL were down 1.77% amid continued selling pressure after the conglomerate called off its deal with Saudi Arabian public petroleum and natural gas company Saudi Aramco last week. Shares of Adani Enterprises, on the other hand, jumped 2.34% on Wednesday, taking its chairman’s wealth just past Ambani’s net worth.

Last month, Ambani joined the likes of Tesla and SpaceX CEO Elon Musk and Amazon founder Jeff Bezos in the world’s ultra-rich list as his wealth crossed the $100 billion mark, according to Bloomberg.

Adani’s conglomerate operates a slew of companies including Adani Enterprises, Adani Green Energy, Adani Ports & SEZ, Adani Transmission, Adani Total Gas, and Adani Power, among others.

IITian entrepreneur from Himachal enters top 10 Richest Indian List 2021

Adani Transmission Limited (ATL), one of the group’s companies and India’s largest private sector power transmission and retail distribution company, on November 11 won three awards at the Confederation of Indian Industry (CII)’s first-ever Operational Sustainability Conference-cum-Competition.

While the total market capitalisation of the listed Adani Group companies is pegged at Rs 10 trillion compared to RIL’s market capitalisation of Rs 14.91 trillion, Adani has a higher promoter holding in his listed group firms.