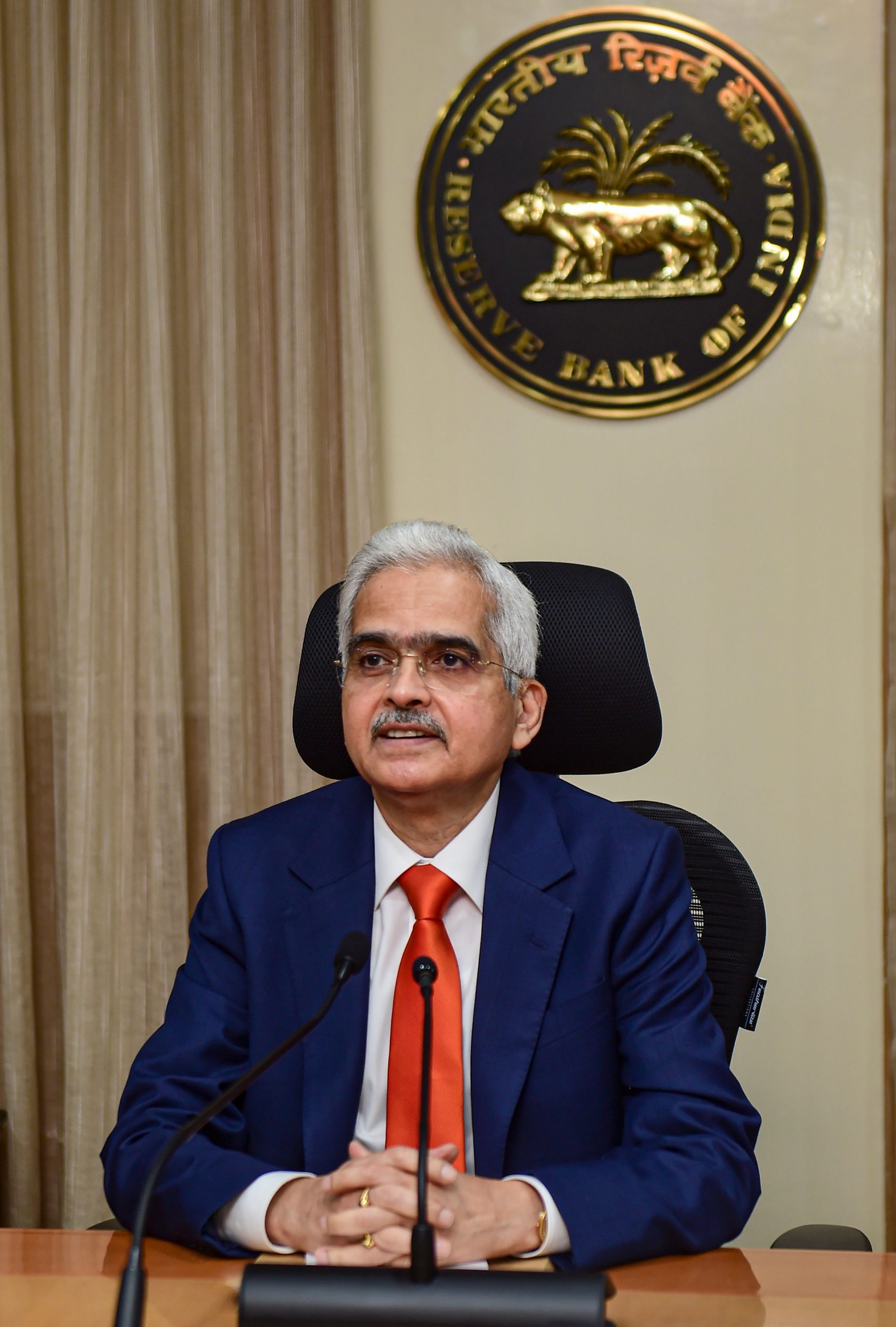

India is likely to be among the fastest-growing major

economies this financial year, geopolitical turbulence notwithstanding, Reserve

Bank of India’s Shaktikanta Das said in the minutes of the central bank’s

monetary policy meeting held last month.

On September 30, the six-member Monetary Policy Committee (MPC), headed by Das, hiked the short-term lending rate for the third straight time by

50 basis points to take the repo rate to 5.9%. In May, the repo rate was raised

by 40 basis points.

Except for Ashima Goyal, who favored a 35 basis points

hike, the other five members had voted for a 50 bps hike in the repo rate.

Also Read | RBI MPC meet: How a repo rate hike will impact your money

According to the minutes of the MPC meeting released by RBI

on Friday, Governor Das had said that economic activity was steadily improving,

though there were mixed signals. High-frequency indicators are showing

continued momentum in activity and global factors are putting pressure on

external demand.

The Governor said the growth projection of 7% for the

financial year 2022-23, therefore, carries risks that are badly balanced.

Whatever the upcoming scenario, India is expected to be among the

fastest-growing major economies in the world.

Also Read | Why has Decathlon reversed its name to Nolhtaced in Belgium?

“The future trajectory remains clouded with

uncertainties arising from continuing geopolitical conflicts, the possibility

of further supply disruptions, volatile financial market conditions, and

domestic weather-related factors,” Das said.

“The need of the hour is calibrated monetary policy

action, with a clear understanding that it is required for sustaining our

medium-term growth prospects,” he added.

The increase repo rate was necessary to combat inflationary

risks, said minutes released on Friday.

Also Read | India wholesale price-based inflation eases to 10.7% in September

RBI Deputy Governor and MPC member Michael Debabrata Patra

emphasized that monetary policy has to perform the role of nominal anchor for

the economy as it charts a new growth trajectory.

The focus should be on being time consistent in aligning

inflation with the target, Patra said.

“In this context, front-loading of monetary policy

actions can keep inflation expectations firmly anchored and balance demand

against supply so that core inflation pressures ease,” he added.

Also Read | Elon Musk under investigation over $44 billion takeover deal, says Twitter

Shashanka Bhide also said to align the inflation expectations

with the policy target of inflation, further increase in policy rates is

necessary at this juncture.

On the other hand, some members warned that while the rate

action is necessary to control inflationary risks, relentless monetary

tightening may not be appropriate.

Ashima Goyal said the MPC must move “very carefully” now

that forward-looking real interest rates are positive. She warned that if

lagged effects of monetary policy are large, as in India, overreaction can be

very costly.

Also Read | Why interest rates are being hiked globally?

Most analysts were arguing for a 50 bps rise in the repo

rate just to preserve a spread with US policy rates. This is a “fear-driven

over-reaction,” Goyal said.

According to external member Jayanth Varma, the MPC should

raise the policy rate to 6% and then pause because monetary policy acts with

lags. It may take 3-4 quarters for the policy rate to be transmitted to the

real economy, and the peak effect may take as long as 5-6 quarters.

Also Read | RBI MPC meet: How a repo rate hike will impact your money

“If we were to continue to tighten without a reality check,

we would run the risk of overshooting the repo rate needed to achieve price

stability. In my view, it is dangerous to push the policy rate well above the

neutral rate in an environment where the growth outlook is very fragile,” Varma

added.

Another member Rajiv Ranjan said in the current

macroeconomic mix, while a rate hike was imminent, the choice between a 35 to

50 bps was “a close call.”

Also Read | Current global crisis and hyperinflation in post-World War I Germany

However, monetary policy has to persevere with its exit

from accommodation to ensure that calibrated policy rate hikes dampen inflation

expectations and firmly establish our commitment to price stability, he added.

This would help achieve the optimal mix of growth and

inflation which will set the foundations for a high growth trajectory over the

medium term, said Ranjan.

Also Read | IMF calls India’s direct-benefit-transfer scheme a ‘logistical marvel’

The RBI, which has been directed to ensure retail inflation

remains at 4% (with a margin of 2% on either side), has failed to meet the

target for three consecutive quarters, and now will have to submit a report in

this regard to the government.