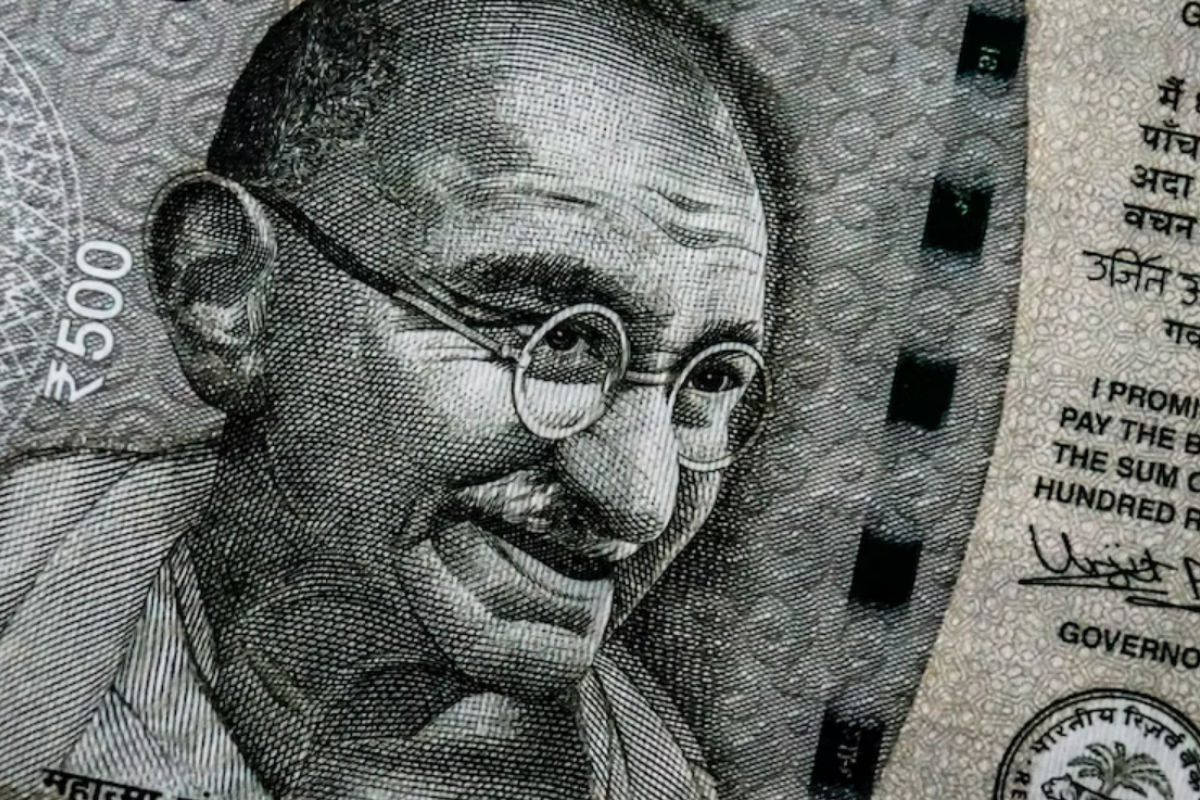

The rupee gained 30 paise to settle at 81.77 against the US dollar on Thursday erasing some recent gains. Demand for the US dollar by importers and banks rose which consequently put pressure on the rupee.

The local currency began weaker at 81.61 against the US dollar at the interbank foreign exchange market. It recorded a high-low of 81.54 and 82.92 on Wednesday. It finally closed 30 paise lower at 81.77 against the US dollar.

Also Read: US inflation falls to 7.7% in October, lower than expectations

“Rupee came under pressure in the first half of the session ahead of the US inflation number that will be released today. The expectation is that inflation could come in lower and that could keep gains capped for the dollar,” said Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services. Also, market participants remained cautious ahead of mid-term election results.

Also Read: US Premarket: AstraZeneca, Rivian, Nio and other stocks making biggest moves

The rupee fell 45 paise to settle at 81.47 against the dollar in the previous session on Wednesday.

The dollar index, which measures the US Dollar’s strength against a basket of six currencies, rose by 0.14% to 110.70.

Concurrently, Brent crude futures, the international oil benchmark rose 0.03% to $92.68 per barrel.

Also Read: Tata Motors, Nykaa, Piramal and other stocks that moved most on November 10

Gold prices on the Multi Commodity Exchange (MCX) appreciated on Thursday, November 10, 2022, at around 7:15 pm. Gold futures were trading at Rs 51,940 per 10 gm, up 434 points or 0.84%, in the Indian market. Silver futures were trading at Rs 62,482 per kg, up 921 points or 1.50%.

Copper futures were trading at Rs 687.55 up 1.19% while Natural Gas and Aluminium futures were trading at Rs 493.20 per MMBtu and Rs 202.60 per Kg respectively on MCX.

Also Read: Aurobindo Pharma plunges 9% after ED arrests director Sarath Reddy

The BSE Sensex 419.85 or 0.69% to close at 60,613.70 on the domestic stock market, Similarly, the NSE Nifty lost 128.80 or 0.71% to settle at 18,028.20.

According to exchange data, foreign Institutional Investors (FIIs) were net buyers in the equity markets as they purchased shares worth Rs 386.83 crore, while Domestic Institutional Investors sold shares worth Rs 1,060.12 crore on Wednesday, November 09, as per data available on NSE.