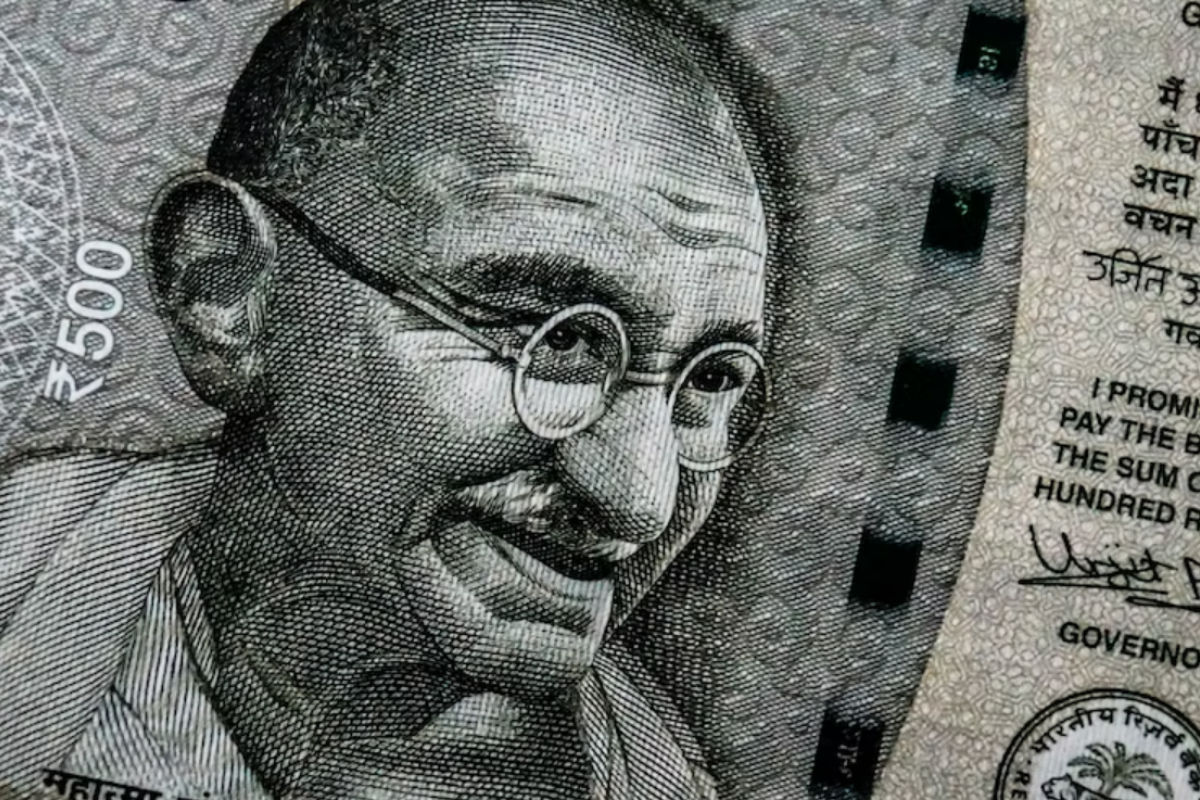

The rupee fell 48 paise to settle at 81.26 against the US dollar on Monday due to strengthening US dollar and flat domestic equity markets.

The local currency began stronger at 80.53 against the US dollar at the interbank foreign exchange market. It finally closed 48 paise lower at 81.26 against the US dollar.

Also Read: Jeff Bezos says he will donate most of his $124 billion net worth to charity

“Indian Rupee depreciated on recovery in US Dollar and weak domestic markets. However, Rupee opened higher on upbeat macroeconomic data,” said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

“Overall weakness in the Dollar amid rising expectations of the not-so-aggressive Federal Reserve may also support the Rupee at lower levels. Sustained FII inflows may also support Rupee. However, higher crude oil prices may cap the sharp upside,” Choudhary added.

Also Read: Glenmark, LIC, Paytm, and other stocks that moved most on November 14

The rupee gained 62 paise to settle at 80.78 against the dollar in the previous session on Friday.

The dollar index, which measures the US Dollar’s strength against a basket of six currencies, rose by 0.59% to 106.91.

Concurrently, Brent crude futures, the international oil benchmark declined 0.63% to $95.93 per barrel.

Also Read: India WPI inflation eases to 8.39% in October, lowest since March 2021

Gold prices on the Multi Commodity Exchange (MCX) appreciated on Monday, November 14, 2022, at around 5:40 pm. Gold futures were trading at Rs 52,510 per 10 gm, up 176 points or 0.34%, in the Indian market. Silver futures were trading at Rs 61,813 per kg, up 242 points or 0.39%.

Copper futures were trading at Rs 697.65 down 0.66% while Natural Gas and Aluminium futures were trading at Rs 505.50 per MMBtu and Rs 211.65 per Kg respectively on MCX.

Also Read: Retail inflation in India falls to 6.77% in October

The BSE Sensex fell 170.89 or 0.28% to close at 61,624.15 on the domestic stock market, Similarly, the NSE Nifty lost 20.55 or 0.11% to settle at 18,329.15.

According to exchange data, foreign Institutional Investors (FIIs) were net buyers in the equity markets as they purchased shares worth Rs 3,958.23 crore, while Domestic Institutional Investors (DIIs) bought shares worth Rs 629.15 crore on Friday, November 11, as per data available on NSE.