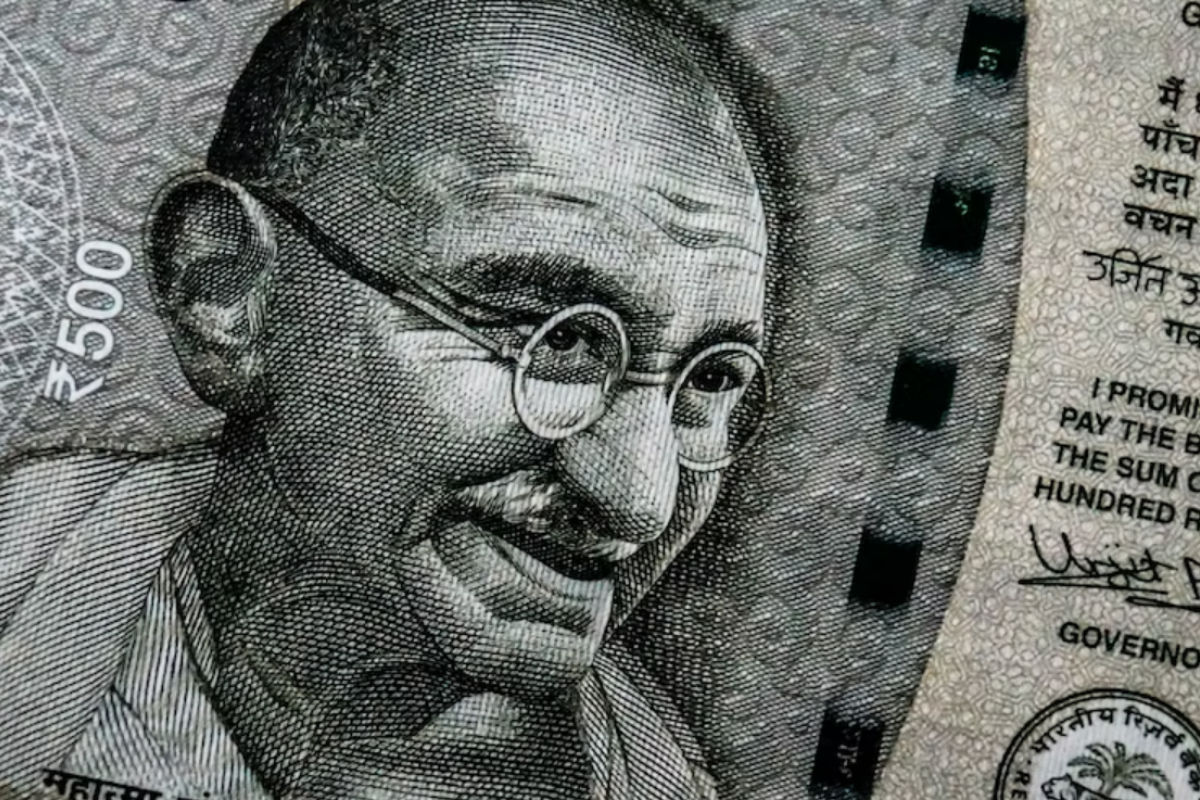

The rupee slipped by 10 paise to settle at 82.90 against the US dollar on Thursday after the US Federal Reserve hiked interest rates by 75 basis points and continued its monetary tightening to curb raging inflation.

Also Read: US Federal Reserve hikes interest rates by 75 basis points

The local currency began weaker at 82.87 against the US dollar at the interbank foreign exchange market. It recorded a high-low of 82.74 and 82.92 on Thursday. It finally closed 10 paise lower at 82.90 against the US dollar.

The rupee fell 21 paise to settle at 82.80 against the dollar in the previous session on Wednesday.

Also Read: Why is RBI MPC holding an off-cycle meet on November 3

The dollar index, which measures the US Dollar’s strength against a basket of six currencies, rose by 1.39% to 112.89.

The Brent crude futures, the international oil benchmark fell 1.16% to $92.04 per barrel.

Gold prices on the Multi Commodity Exchange (MCX) slipped on Thursday, November 3, 2022, at around 6:00 pm. Gold futures were trading at Rs 50,120 per 10 gm, down 486 points or 0.96%, in the Indian market. Silver futures were trading at Rs 57,327 per kg, down 1,463 points or 2.49%.

Also Read: Top 5 cryptocurrencies of the day: Bitcoin falls, Dogecoin trends at no. 1

Copper futures were trading at Rs 648.70 down 1.35% while Natural Gas and Aluminium futures were trading at Rs 497.80 per MMBtu and Rs 198.65 per Kg respectively on MCX.

The BSE Sensex fell 69.68 points or 0.11% to end at 60,836.37 on the domestic stock market, Similarly, the NSE Nifty lost 30.15 points or 0.17% to settle at 18,052.70.

Also Read: Adani Wilmar, HPCL, Wipro and other stocks that moved most on November 3

According to exchange data, foreign Institutional Investors (FIIs) were net buyers in the equity markets as they purchased shares worth Rs 1,436.30 crore, while Domestic Institutional Investors sold shares worth Rs 1,378.12 crore on Wednesday, November 2, as per data available on NSE.