Sri Lanka will need about $3 billion in external support

within the next six months to help restore supplies of essential items,

including fuel and medicines and to manage a severe economic crisis, the

finance minister said on Saturday.

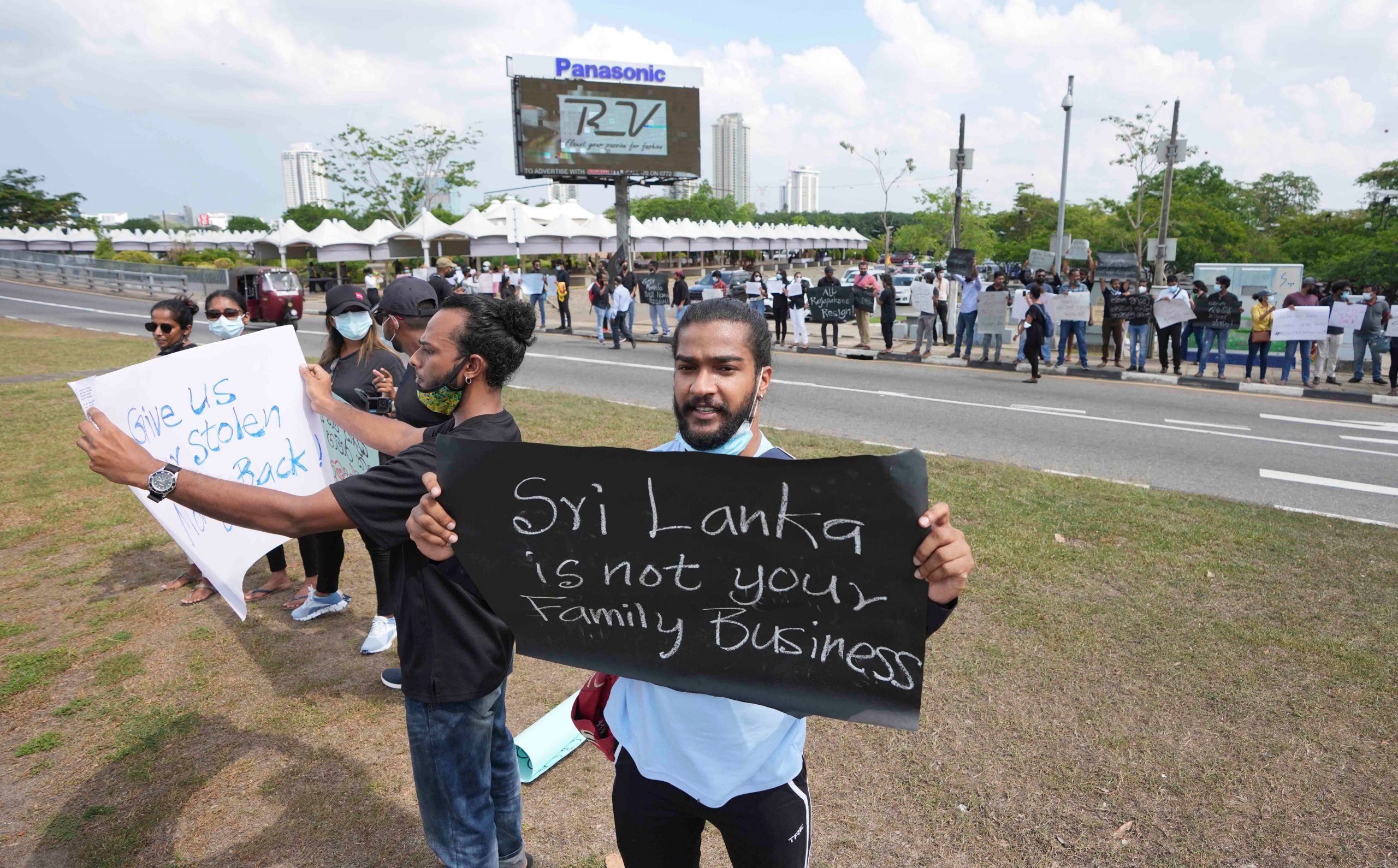

The island country with a population of 22 million people

has been suffering from prolonged power cuts, shortages of medicines, fuel and

other items, which brought angry protesters out on the street and put President

Gotabaya Rajapaksa under immense pressure.

Also Read | Sri Lanka hikes interest rates by 700 basis points to tackle inflation amid economic crisis

“It’s a Herculean task,” Finance Minister Ali

Sabry told Reuters in his first interview since taking charge this week,

referring to finding $3 billion in bridge financing as the country prepares for

negotiations with the International Monetary Fund (IMF) this month.

According to Reuters, Sri Lanka plans to restructure international sovereign bonds and seek a moratorium on payments and is confident of negotiating with

bondholders for an upcoming payment of $1 billion in July.

Also Read | US issues new advisory, asks citizens to ‘reconsider’ travel to Sri Lanka

Sabry said that the entire effort is not to go for a hard

default. “We understand the consequences of a hard default,” he

added.

According to JP Morgan analysts, Sri Lanka’s gross debt

servicing would be around $7 billion this year, with the current account

deficit amounting to $3 billion.

Sri Lanka will look for another $500 million credit line

from India for fuel, which would be adequate for around five weeks of demands,

Sabry said.

Also Read | India ships food aid to Sri Lanka as unrest in Colombo worsens

The government is also eyeing some support from the Asian

Development Bank, the World Bank, and bilateral partners including China, the

United States, Britain and countries in the Middle East, reported Reuters.

Sri Lankan authorities have asked for a $1 billion loan

from China to meet the existing repayments to China, and a $1.5 billion credit

line to purchase Chinese goods.

Also Read | ‘Sold everything to China’: Why are Sri Lankan traders mad at Rajapaksas

Sri Lanka’s new

central bank governor, Nandalal Weerasinghe, emphasized the importance of

working closely with the International Monetary Fund (IMF). To expedite funding

for the country, Sri Lanka will send a strong team to the Spring Meetings of

the IMF and the World Bank, he said. The central bank will appoint legal and

financial advisors for debt restructuring within two weeks.