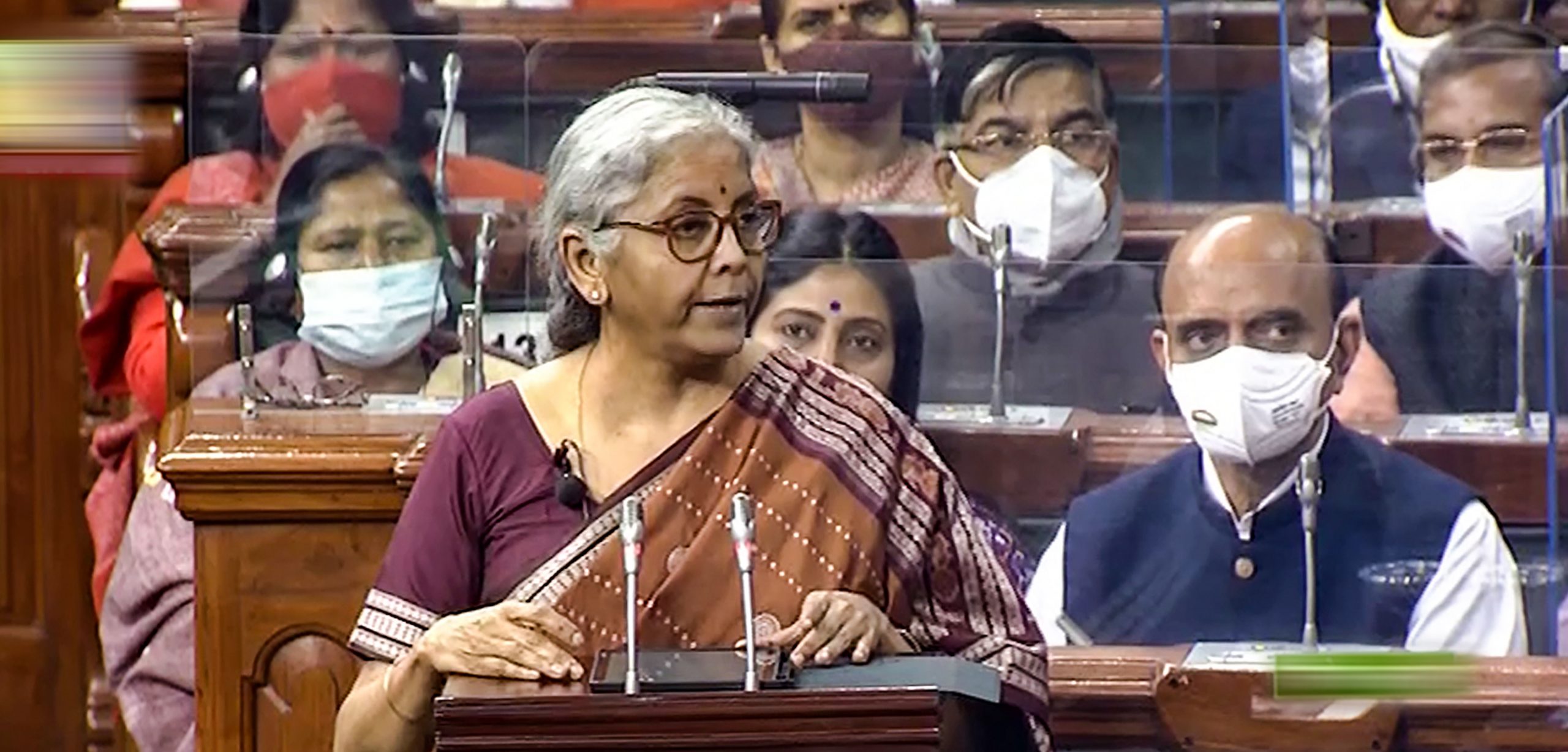

Finance

Minister Nirmala Sitharaman presented the Union Budget for the

financial year 2022-23 on Tuesday. This was Sitharaman’s fourth straight budget and the second

paperless in view of the ongoing COVID-19 pandemic. The Union Cabinet approved the Budget at a meeting attended by the Finance Minister, Prime Minister Narendra Modi, Home Minister Amit Shah and others.

Sitharaman outlined “inclusive development, productivity enhancement, energy transition and climate action” as the “four pillars of the Budget.” The Budget will be guided by the ‘PM Gati Shakti’ master plan and will benefit, youth, women, farmers, SCs and STs, she added.

The Budget seeks to lay the “blueprint” for the ‘Amrti Kal’ for the next 25 years, from “from India at 75 to India at 100”, Sitharaman said.

The Finance Minister did not announce any change in the income tax slabs for 2022-23, while the income tax rates were also not revised.

The FM announced that any income from transfer of any digital asset will be taxed at 30%. “No deduction in respect of any expenditure or allowance shall be allowed while computing such income, except cost of acquisition,” she added.

Corporate surcharge has been reduced from 12% to 7%, while both Centre and states governemnt employees’ tax deduction limit will be increased from 10% to 14%. In addition, co-operative surcharge to be reduced from 12% to 7%.

Also Read | Budget 2022: What equity market is expecting from government?

Taxpayers will also be allowed to file updated return within two years from the relevant assessment year, Sitharaman added.

The total expenditure for the financial year 2022-23 is estimated at Rs 39.45 lakh crore. The fiscal deficit was at 6.9% of GDP in 2021-22 and is estimated to be at 6.4% in 2022-23.

Sitharaman announced that the Reserve Bank of India (RBI) will issue a digital Rupee using blockchain and other technologies in 2022-23. “This will give a big boost to the economy,” she added.

The FM also said that the required spectrum auctions will be conducted this year to facilitate the rollout of 5G mobile services within 2022-23 by private telecom providers.

“A scheme for design-led manufacturing will be launched to build a strong ecosystem for 5G as part of the production-linked incentive scheme”.

A new E-passport, which will be embedded with a chip, will be rolled out in 2022-23 to enhance convenience for citizens, Sitharaman said.

Sitharaman announced a ‘National Tele Mental Health‘ program as the pandemic and the consequent lockdowns have accentuated the mental health issues in people of all ages.

Sitharaman announced that a Rs 6,000 crore programme to rate MSMEs will be rolled out within the next five years. “MSMEs such as Udyam,e-shram, NCS and Aseem portals will be interlinked,their scope will be widened.”

Also Read | India Union Budget 2022: Task force to be set up to tap potential of animation, gaming, comic sectors

The Finance Minister said that the PM Gati Shakti master plan for expressways will be formulated in 2022-23 and will facilitate faster movement of people and goods. National Highway network to be expanded by 25,000 km in 2022-23. Rs. 20,000 crores to be mobilized to complement public resources are among the measures that will be taken under the master plan.

Further in infrastructure, Sitharaman announced 400 new generation Vande Bharat trains that will be brought in within the next three years. 100 PM Gati Shakti Cargo terminals will be developed during next three years and implementation of innovative ways for building metro system.

The Finance Minister also said that Rs 2.37 lakh crore will be directly paid to farmers as MSP price for wheat and paddy crop procurement. Chemical-free farming methods will be promoted across the country with a focus on the corridor around the river Ganga in the first phase.

Sitharaman started her address by paying homage to all lives lost during the COVID-19 pandemic. The FM said that India’s economic growth in the current year is estimated at 9.2%, adding that the sharp rebound is “reflective of our country’s strong resiliance”.

Also Read | Union Budget 2022, Defence: Stronger Aatmanirbhar push for indigenous industry

“I recognise we are in the midst of a omicron wave, with high incidents but milder symptoms. Further, the speed and coverage of our vaccination campaign has helped greatly. With an accelerated improvement in health infrastructure in the past two years, we are in a strong position to withstand challenges.”

The tone

for the Union Budget was set by the Economic Survey 2021-22, which Sitharaman

presented on Monday, projecting the economy to grow at a healthy 8-8.5% in the

2022-23 fiscal, down from the 9.2% growth for the 2021-22 forecast by the

National Statistical Office (NSO).

It also stated that the government has the capacity

to do more to support the economy.

Also Read | Union Budget 2022: A look at India’s most historic budgets

The budget

comes days before the first phase of voting in Uttar Pradesh, which along with

four other states is going to the polls to elect a new state government. And

naturally, it is expected to contain measures for higher rural and agriculture

spending.

Analysts

said the finance minister will have to strike a fine balance while keeping up

the momentum of the country’s promising but fledgling economic recovery and tax

collections, but at the same time look at bringing in measures to spur demand,

create jobs and tackle inflation as the country deals with the ongoing third

wave of the COVID pandemic.

While it is

not clear if Sitharaman will change the income tax rates, the exemption limit

of Rs 2.5 lakh is expected to be raised.