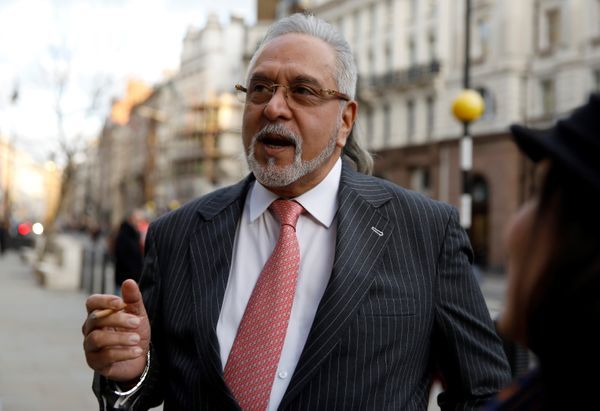

Fugitive businessman Vijay Mallya’s Kingfisher House, the headquarters of the now-defunct Kingfisher Airlines, has been sold to a Hyderabad-based private developer for Rs 52 crore. This comes weeks after Mallya was declared bankrupt by a British court, paving the way for a consortium of Indian banks led by the State Bank of India (SBI) to pursue a worldwide freezing order to seek repayment of debt owed by Kingfisher.

The Kingfisher House, founded by Vijay Mallya, was first put out to auction in March 2016 with a reserve price of Rs 150 crore. Hyderabad-based Saturn Realtors have now bought it at Rs 52.25 crore — about one-third of its recent reserve price of Rs 135 crore, moneycontrol.com reported.

Also Read| Vijay Mallya: What are the charges against him

The property is situated near Mumbai’s Chhatrapati Shivaji Maharaj International Airport in Santacruz. It had failed to attract a buyer for the eighth time during an auction in November 2019. The money received from the sale will go to the lenders that have already recovered Rs 7,250 crore through the auction of shares of Mallya. Kingfisher Airlines owes about Rs 10,000 crore to a consortium of banks in India led by the State Bank of India (SBI).

Also read: What propelled Sensex past the 55,000 mark

“As at 15.42 [UK time], I adjudicate Dr Mallya bankrupt,” Chief Insolvencies and Companies Court (ICC) Judge Michael Briggs said during a virtual hearing of the Chancery Division of the High Court in July.

Also read: Veteran industrialist Adi Godrej to step down as chairman of Godrej Industries

Represented by the law firm TLT LLP and barrister Marcia Shekerdemian, the Indian banks had argued for the bankruptcy order to be granted in favour of the Indian banks.

Mallya’s legal team contended that the debt remains disputed and that the ongoing proceedings in India inhibited a bankruptcy order being made in the UK.

The debt in question comprises principal and interest, plus compound interest at a rate of 11.5% per annum from 25 June 2013. Mallya has made applications in India to contest the compound interest charge.