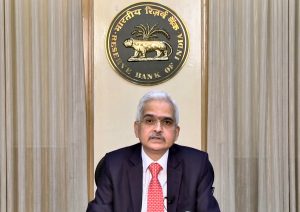

In its first bi-monthly monetary policy, the Reserve Bank of India decided to keep its repo rate and reverse repo rate unchanged at 4% and 3.35% respectively.

But what does the term monetary policy mean?

Monetary policy is called the demand side of economic policy. Monetary policy is the actions taken by the RBI to control the supply of money in the economy, to promote sustainable growth.

Reserve Bank of India (RBI) administers and monitors monetary policies to control liquidity, credit availability, inflation and economic growth of the country. These monetary policies help RBI in promoting investments and increasing diversification in financial markets along with improving the market%u2019s efficiency.

Repo and Reverse Repo rates are such tools of the central bank of India%u2019s monetary policy to help regulate the supply of money in the economy.

The RBI has a Monetary Policy Committee (MPC) that decides about the monetary policy, including the rates of repo rates and reverse repo rates.