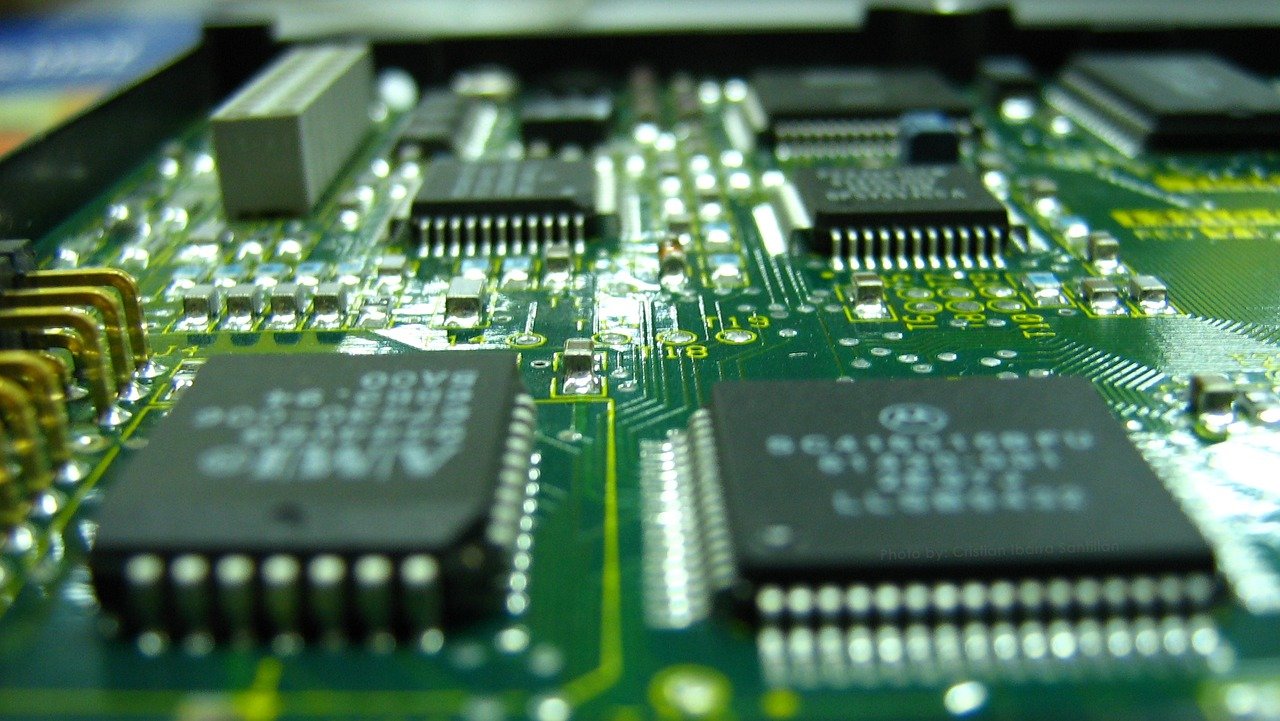

Vedanta is in talks with banks to raise debt of $2.5

billion-$3 billion to support its semiconductor and display manufacturing plans

as it aims to become the country’s first chipmaker, reported Reuters.

In February, the oil-to-metals conglomerate announced to

diversify into chip manufacturing and formed a joint venture with Taiwan’s

Foxconn. It has a total planned investment outlay of $20 billion.

Also Read | India hits a century of unicorns boosting startup economy

Vedanta is seeking incentives from the central government

and state governments. The company plans to raise bank debt of around $3

billion after getting subsidies and its definitive agreements in place.

“We have financial banking relationships across India. We

are talking to them,” said Akarsh Hebbar, Vedanta’s Global Managing Director of

Display and Semiconductor Business.

Also Read | Explained: How the crypto landscape has changed in India

The company is also looking for a chief executive officer

for its joint venture with Foxconn. Hebbar said Foxconn employees will be

deployed for its semiconductor plant, which is expected to start operations in

2025.

According to a Reuters report, Vedanta is seeking

incentives such as 1,000 acres (405 acres) of free land, cheaper water and

power from state governments for its entry into semiconductors and displays

business.

Also Read | LIC to launch IPO for anchor investors today: 5 things to know

The company is targeting mid-May for site selection from

a state and is in talks with Gujarat, Maharashtra and Telangana governments,

said Hebbar.

It has also approached the governments of Karnataka and

Odisha for its plants and is awaiting responses on possible incentives it can

get. The company is expecting a return on investment of 10-15% over 15-20 years

and a breakeven may happen somewhere in the middle, he added.

Also Read | LPG cylinder prices hike again by Rs. 102, now cost Rs. 2,355.50

On Friday, Modi and his IT ministers highlighted plans

for more investment incentives, saying that they want India to emerge as a

major player in the global chips market, now dominated by manufacturers in

Taiwan and a few other countries.

Semiconductors are critical to establishing India as an

electronics hub and will attract suppliers and device assemblers to set up a

base in India. “The same revolution that happened in China will end up

happening here,” Hebbar said.

Also Read | Why young Indians are no longer seeking jobs

India’s semiconductor market is projected to reach $63

billion by 2026, compared with $15 billion in 2020, according to the

government.