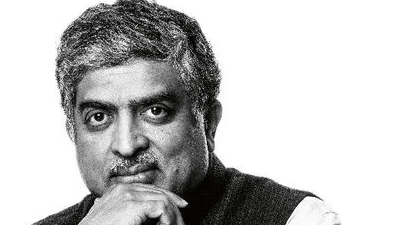

Nandan Nilekani, chairman of software services exporter Infosys, said at the Reuters Next Conference on Wednesday that crypto assets are worth consideration and may be used to increase financial inclusion.

Also Read| India announces bill to ban all private cryptocurrencies

“There is a role for crypto as assets, but they obviously will have to follow all of the laws and make sure that it doesn’t become a backdoor for money laundering… they have to use that [as] an entry point to get a lot of young people into financial markets,” said Nilekani, who co-founded Infosys, India’s second-biggest IT firm, in 1981.

Also Read| IMF advises El Salvador against using bitcoin as legal tender

Because of its high transaction costs and volatility, cryptocurrency is not fit for transactions, according to Nilekani, a well-connected technocrat who also played a crucial part in the creation of India’s 1.3 billion-strong biometric database.

Also Read| Crypto Fear and Greed Index on December 2, 2021

Nilekani’s remarks come at a time when India’s central government is seeking to discourage cryptocurrency trading by charging high capital gains taxes and is also looking to categorize cryptocurrency as an asset class. Union Finance Minister Nirmala Sitharaman on Wednesday said that the Centre will introduce a bill on cryptocurrencies in the Parliament after Cabinet’s approval.

Also Read| Gold, silver and other metal prices on December 2, 2021

New Delhi has stated that only certain cryptocurrencies would be permitted to promote the underlying technology and its uses.

“If we have a very well-regulated and legal, lawful crypto market, not as currency but as assets, and a lot of young people build innovative applications around it, then these young people may create a wave of global companies,” Nilekani added.

Also Read| Petrol dropped to Rs 95.41, diesel Rs 86.67 in Delhi; check December 2 fuel prices

According to industry estimates, India has 15 million to 20 million crypto investors, with total crypto holdings of roughly 400 billion Indian rupees ($5.35 billion).

In his first public remarks on the matter, India’s Prime Minister Narendra Modi stated in November that all democratic nations must work together to ensure that cryptocurrency “does not end up in wrong hands, which can spoil our youth.”

The experimental launch of India’s central bank’s digital currency is possible in the first quarter of the next fiscal year.

Also Read| Trade Setup: Top 15 things to know before market opens on December 2, 2021