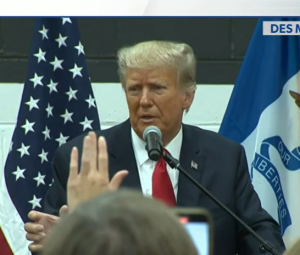

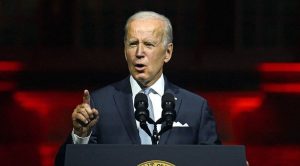

The Biden administration is currently deliberating the future of former President Trump’s import taxes on steel and other metals. Gina Raimondo, the commerce secretary had earlier said that the tariff “helped save American jobs in the steel and aluminium industries,” in a possible sign of continuing the policy.

Even though American companies are paying hefty amounts of tariff on imported steel, removing this tax could expose the industry to tough competition rallied by cheap foreign metal. China, for example, has flooded the global market with subsidized steel. The steel industry of the US can only compete against these prices under government protection.

“It’s not great for us. The tariffs were a blunt instrument. But we need a domestic steel industry,” Washington Post quoted Bernard, president of Eagle Metals as saying.

Also Read: US bill to pressure China on trade and rights, back Taiwan

The Biden administration may be reviewing its trade policy and welcoming the market distortions against subsidized foreign rivals including the fees of 10% on aluminium and 25% on steel, reported the Washington Post.

This perspective of the steel importers could showcase the base for Biden’s “worker-centred” trade policy arising out of one of Trump’s most controversial policies that drew criticism from all over.

Senior fellow and trade attorney Scott Lincicome said, “They like the power they have and the potential to use the law for their goals. In this case, climate is the big one.”

Also Read: Senate unanimously confirms Katherine Tai as US Trade Representative

A Vogel Group lobbyist, Samir Kapadia, said “The 232 isn’t going anywhere,” in reference to Section 232 on tariffs, which shows how temporary trade limits can become semi-permanent, Washington Post reported.

The US president is granted full authority to use tariffs against a national security threat. For the current administration, this provision could be used as a tool to put checks in place to combat climate change, reported the Washington Post.

Last year, imports accounted for only 18% of U.S. steel consumption as compared to 30% in 2018. Organizations of the steel industry say that the current tariffs have created 3,200 new jobs and spent over $15.7 billion on the reopening of facilities and mill upgrades. But no surge in jobs has been recorded.

According to the Bureau of Labor Statistics, employment rose to 144,000 from 139,200 when Trump imposed the policy before the COVID-19 pandemic and then dipped to 135,000 in the mills, blast furnaces, and foundries industry.

President of B. Walter & Co, Scott Buehrer said, “The conditions in the steel market no longer support the need for these tariffs. In fact, their continuation jeopardizes the future of the U.S. steel industry due to the situation this has placed their customers in.”

“These supply issues are only going to get worse if the infrastructure bill passes and the demand for domestic steel spikes even higher. Lead times and availability will be a serious issue for U.S. manufacturers,” said Brian Murphy, Eagle Metals’ vice president.

“We just want to have the same pricing as our competitors. [The tariff] makes us the high-cost producer,” he added.